One in five U.S. workers (21 percent) indicate their confidence in their ability to retire comfortably has declined in light of the coronavirus pandemic – and only 27 percent are very confident that they will be able to fully retire with a comfortable lifestyle, according to Retirement Security: A Compendium of Findings About U.S. Workers (“Compendium”), a new survey report released by the Transamerica Center for Retirement Studies (TCRS).

“Policymakers can pave the way for improving retirement security by enacting legislation and implementing reforms that can ensure the sustainability of government benefit programs, encourage employers to offer benefits to their employees, and help prepare workers for long, healthy, and productive lives,” says TCRS President and CEO Catherine Collinson.

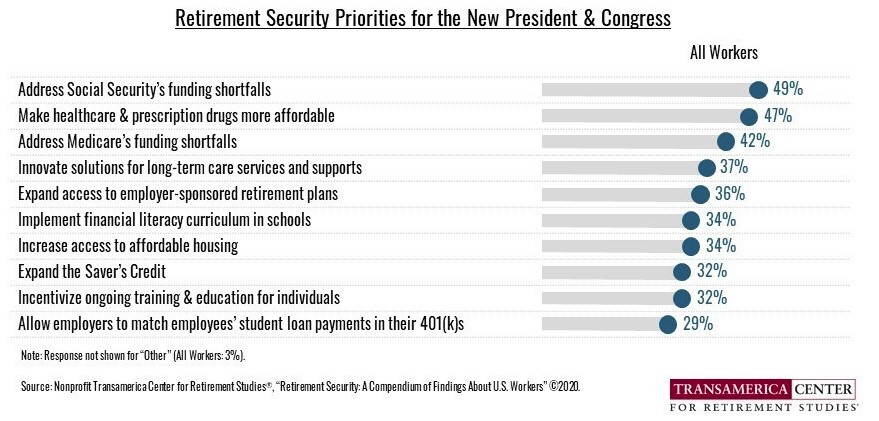

When asked what the priorities for the new president and Congress should be, workers’ most often cited responses involve strengthening safety nets and improving health care, including addressing Social Security’s funding shortfalls (49 percent), making out-of-pocket healthcare expenses and prescription drugs more affordable (47 percent), addressing Medicare’s funding shortfalls (42 percent) and innovating solutions to make long-term care services and supports more affordable (37 percent).