About half of the nation’s private-sector employees do not have a retirement savings plan at work, and that hasn’t changed in at least 40 years, according to a new Squared Away blog post published by the Center for Retirement Research at Boston College.

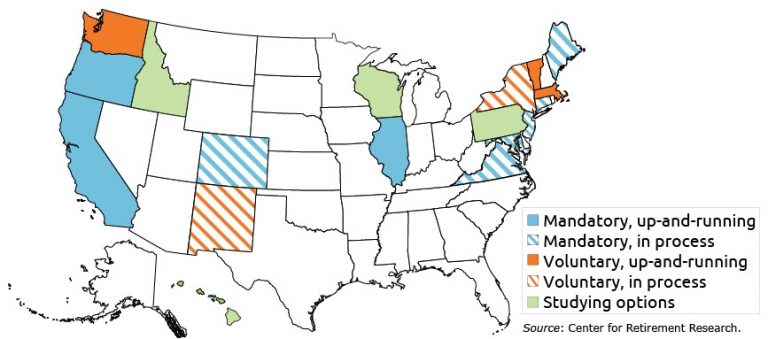

Some states are trying to fix this coverage gap in the absence of substantial progress by the federal government in solving the problem.

In the past year alone, Maine, Virginia, and Colorado have passed bills requiring private employers without a retirement plan to automatically enroll their workers in IRAs, with workers allowed to opt out. New York City, which is more populous than most states, approved its program in May. And other states are either starting to implement programs or looking at their options.

Auto-IRAs are already up and running in California, Illinois, and Oregon, where a total of nearly 360,000 workers have saved more than $270 million so far. The programs are run by a private sector administrator and investment manager. To learn more, read the full blog post.