Historically, the reverse mortgage industry has been primarily based on a single, government-backed product, the Home Equity Conversion Mortgage. Yet as HUD’s ground rules for HECMs keep changing and with new policies every time there is a change in presidential leadership, the question inevitably arises: Can the reverse mortgage industry survive in its traditional mode?

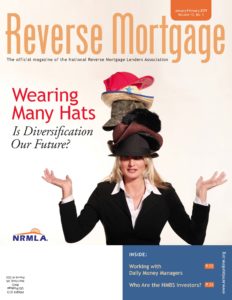

For our cover story, staff writer Mark Olshaker interviewed company executives to find out the direction they are heading and future possibilities, in addition to brainstorming with other key industry figures on ideas for expanding each member’s market.

Recently, there has been a surge in the purchase of private health insurance, known as Medicare Advantage, largely due to an expansion of its permitted uses. We thought it would be of value to our members to cover this trend, the program, its services and its costs, so that you can better inform your potential borrowers.

Over the years, we have published articles on related businesses that can be partners with reverse mortgage originators in helping older adults through retirement, such as financial planners, Realtors and geriatric care managers. This month, we look for the first time at a service that we do not hear a lot of conversation about but, as you will read, is catching on – Daily Money Managers.

All together, a diverse series of stories on diversification.