In a shift that underscores changing dynamics in the housing market, baby boomers now make up the largest generational group of home buyers, according to the National Association … more Baby Boomers Regain Top Spot as Largest Share of Home Buyers

Housing and Home Equity

House Prices Increase Year-Over-Year

U.S. house prices rose 4.5 percent between the fourth quarters of 2023 and 2024, according to the Federal Housing Finance Agency (FHFA) House Price Index, and 1.4 percent … more House Prices Increase Year-Over-Year

States With the Most Home Equity and Retirement Savings

Nearly 60 percent of U.S. households have a net worth of $100,000 or more after accounting for debts, with 29.2 percent having a net worth of $500,000 or … more States With the Most Home Equity and Retirement Savings

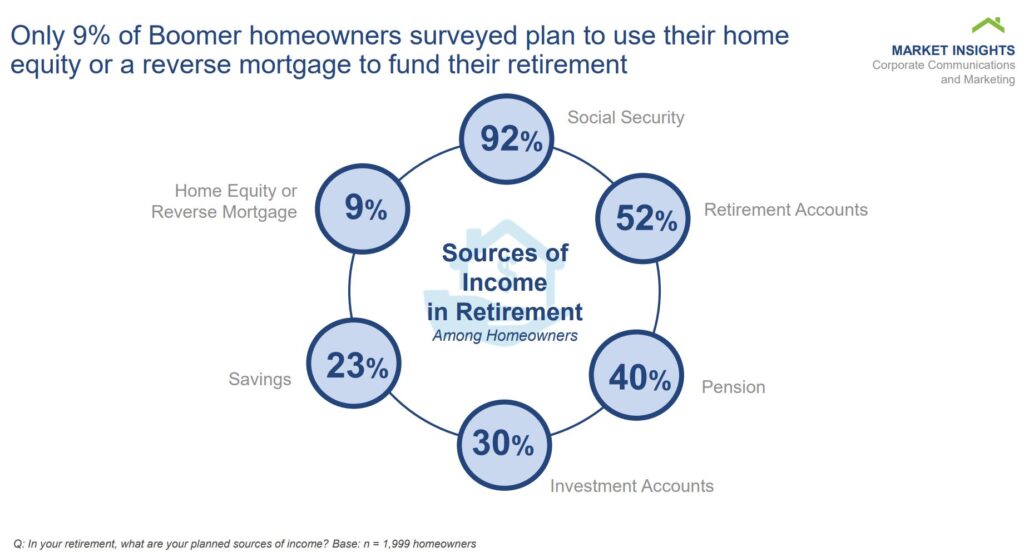

Freddie Mac Surveys Boomers on Housing, Retirement Preferences

A survey conducted by Freddie Mac found that 68 percent of Baby Boomer homeowners expressed confidence in having a comfortable retirement, regardless of race. This is down from … more Freddie Mac Surveys Boomers on Housing, Retirement Preferences

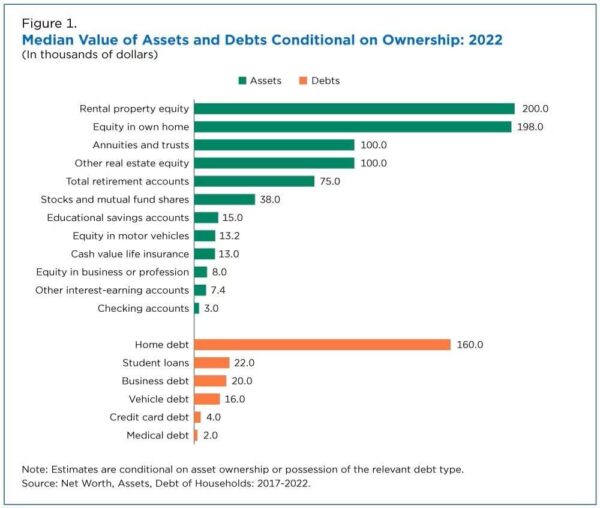

Census Bureau: Median Home Equity Rose by $47,900 From 2019 to 2022

According to the U.S. Census Bureau’s Survey of Income and Program Participation (SIPP), median household net worth increased from $136,500 in 2019 to $176,500 in 2022. The big … more Census Bureau: Median Home Equity Rose by $47,900 From 2019 to 2022

Substandard Housing Conditions Persist in the U.S.

According to government statistics, 6.2 million households live in substandard housing in need of repair. Furthermore, almost 14 percent of U.S. households headed by someone aged 80 and … more Substandard Housing Conditions Persist in the U.S.