You must be logged in to view this content.

State / Local

NRMLA Seeks Revision to WA State Legislation

NRMLA submitted a letter to lawmakers requesting a revision to Senate Bill 5686, so that it more closely matches Washington’s reverse mortgage laws. Dig Deeper: SB 5686 would, … more NRMLA Seeks Revision to WA State Legislation

NRMLA Submits Letter Opposing MD Senate Bill 831

Why it matters: Maryland SB 831, as drafted, requires reverse mortgage lenders to establish escrow accounts so that loan proceeds can be used to pay for property taxes, … more NRMLA Submits Letter Opposing MD Senate Bill 831

NRMLA Opposes NY Bill That Would Create New Disclosure

On behalf of its members, NRMLA submitted a letter to the sponsor of New York Senate Bill 2559 (SB 2559), opposing the bill as drafted. Why it matters: … more NRMLA Opposes NY Bill That Would Create New Disclosure

NRMLA Coordinates Oregon Letter-Writing Campaign

Last week, NRMLA encouraged members in Oregon to communicate with their state senators to express concerns about Senate Bill 534 and the impact it may have on the continued … more NRMLA Coordinates Oregon Letter-Writing Campaign

NRMLA Offers Compromise to Protect Proprietary Reverse Mortgages

NRMLA, with input from the Executive Committee, submitted comments this week to the sponsors of Oregon Senate Bill 534. SB 534 caps the percentage of equity a reverse mortgage … more NRMLA Offers Compromise to Protect Proprietary Reverse Mortgages

NRMLA State and Local Issues Committee to Convene

Legislation has been introduced in Oregon, New York and Hawaii that would impact reverse mortgage companies. Oregon Senate Bill 534 caps the percentage of total equity a reverse … more NRMLA State and Local Issues Committee to Convene

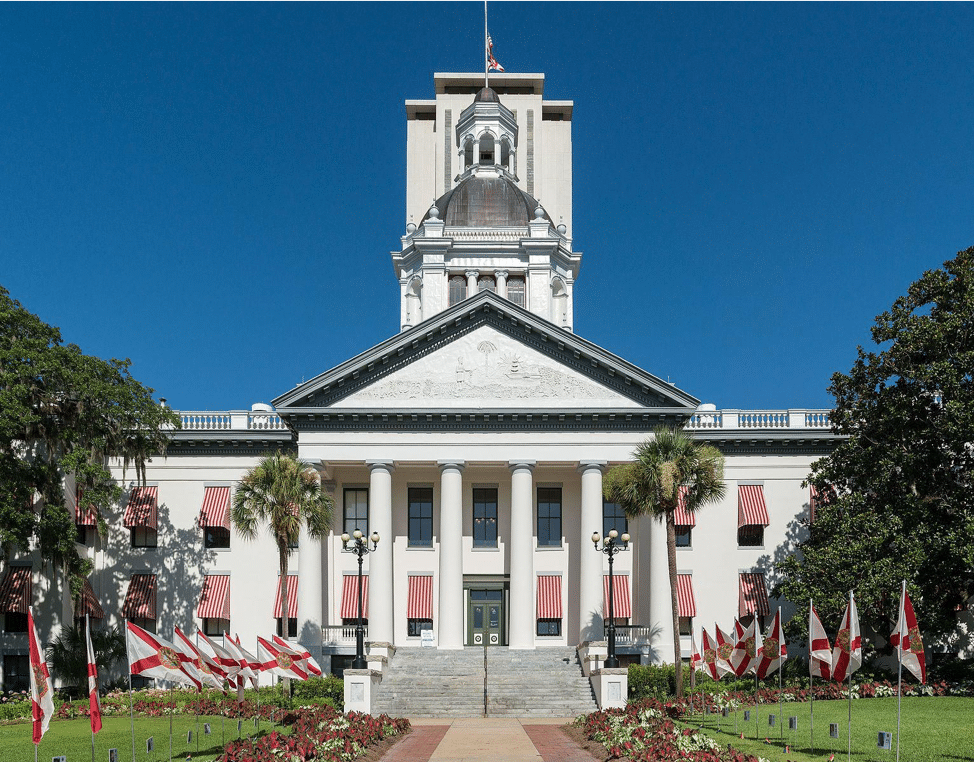

Reverse Borrowers to Benefit from FL Tax Law Change

Florida Governor Ron DeSantis signed legislation (House Bill 7073) that amends existing law by basing the state’s documentary stamp tax on the principal limit of a reverse mortgage … more Reverse Borrowers to Benefit from FL Tax Law Change

Telephone/Video Counseling Made Permanent in MA

Massachusetts Governor Maura Healy signed a Supplemental Budget Bill this week that includes provisions to authorize reverse mortgage counseling via synchronous real-time video conference or telephone on a … more Telephone/Video Counseling Made Permanent in MA

NRMLA Submits Letters of Support

House Bill 7073 and Senate Bill 7074 would amend existing law by basing the state’s documentary stamp tax on the principal limit instead of the maximum claim amount … more NRMLA Submits Letters of Support