On January 31, Treasury Secretary Scott Bessent was named Acting Director of the Consumer Financial Protection Bureau after his predecessor, Rohit Chopra, was fired by President Donald Trump. … more CFPB Effectively Shutdown, For Now

Other

CFPB Proposes Rules to Help Homeowners Avoid Foreclosure

The Consumer Financial Protection Bureau published a proposed rule that would update mortgage servicing rules in Regulation X. What’s next: Public comments are due by September 9, 2024. … more CFPB Proposes Rules to Help Homeowners Avoid Foreclosure

CFPB Takes Action Against Former HUD Contract Sub-Servicer

The Consumer Financial Protection Bureau issued an order to permanently ban Sutherland Global, its subsidiaries Sutherland Government Solutions and Sutherland Mortgage Services, and NOVAD Management Consulting from servicing … more CFPB Takes Action Against Former HUD Contract Sub-Servicer

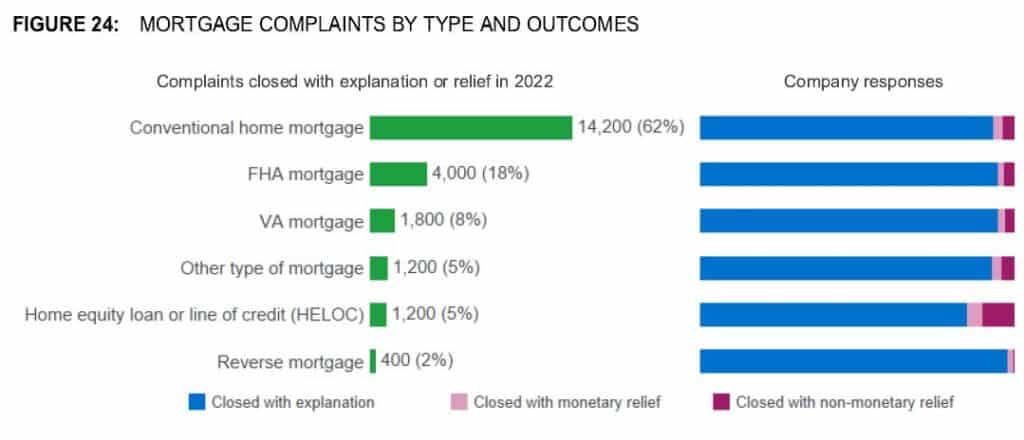

CFPB: Reverse Mortgages Represent Two Percent of Complaints

Out of 27,99 mortgage-related complaints submitted to the Consumer Financial Protection Bureau in 2023, approximately 400, or two percent, were brought against reverse mortgage companies, according to the … more CFPB: Reverse Mortgages Represent Two Percent of Complaints

CFPB Mentions LO Comp In Latest Supervisory Highlights

The Consumer Financial Protection Bureau (CFPB) released the Summer 2023 edition of its Supervisory Highlights this week, which included a section on loan originator (LO) compensation. In describing … more CFPB Mentions LO Comp In Latest Supervisory Highlights

Joint Statement On Completing the LIBOR Transition

The Consumer Financial Protection Bureau issued a joint statement with four other federal regulatory agencies, and state bank and credit union regulators, as a reminder that use of … more Joint Statement On Completing the LIBOR Transition

CFPB Publishes RESPA Section 8 Advisory Opinion

By Weiner Brodsky Kider, PC The CFPB published an Advisory Opinion on February 7, 2023, that sets forth the Bureau’s views on how RESPA Section 8 applies to Digital Mortgage … more CFPB Publishes RESPA Section 8 Advisory Opinion