Joseph M. Gormley joined Ginnie Mae as its new Executive Vice President and Chief Operating Officer where he will oversee the agency’s mission to support stability in the … more Gormley Assumes Top Leadership Role at GNMA

Secondary Markets

Here’s why HMBS 2.0 is so important

Over the past year, NRMLA has worked closely with Ginnie Mae to develop HMBS 2.0 to resolve the liquidity constraints that led to the largest bankruptcy in the … more Here’s why HMBS 2.0 is so important

Ginnie Mae Finalizes HMBS 2.0 Term Sheet

Ginnie Mae published a finalized term sheet for its HECM Mortgage-Backed Securities (HMBS) 2.0 program. The final term sheet was developed in response to comments received and subsequent engagement with … more Ginnie Mae Finalizes HMBS 2.0 Term Sheet

Valverde Resigning as Acting Ginnie Mae President

Ginnie Mae announced last week that Acting President Sam Valverde will be stepping down effective November 30, 2024. Senior Vice President and Chief Risk Officer Gregory Keith will … more Valverde Resigning as Acting Ginnie Mae President

HUD and GNMA Invited Feedback on Two Critical HECM Issues

Working in coordination with the Servicing Committee and HMBS Issuers Committee, NRMLA submitted two sets of comments, one to the Department of Housing and Urban Development and another … more HUD and GNMA Invited Feedback on Two Critical HECM Issues

GNMA Seeks Comments on Proposed HMBS 2.0

Ginnie Mae published a draft term-sheet for its proposed HECM Mortgage-Backed Securities (HMBS) 2.0 program. Comments are due July 31. Why it matters: HMBS 2.0 seeks to address … more GNMA Seeks Comments on Proposed HMBS 2.0

FHA and GNMA Discuss Priorities and Achievements

The following article provides highlights from NRMLA’s Eastern Regional Meeting, May 29, in Washington, DC. During an interview with NRMLA Chairman Mike Kent, Deputy Assistant Secretary for Single-Family … more FHA and GNMA Discuss Priorities and Achievements

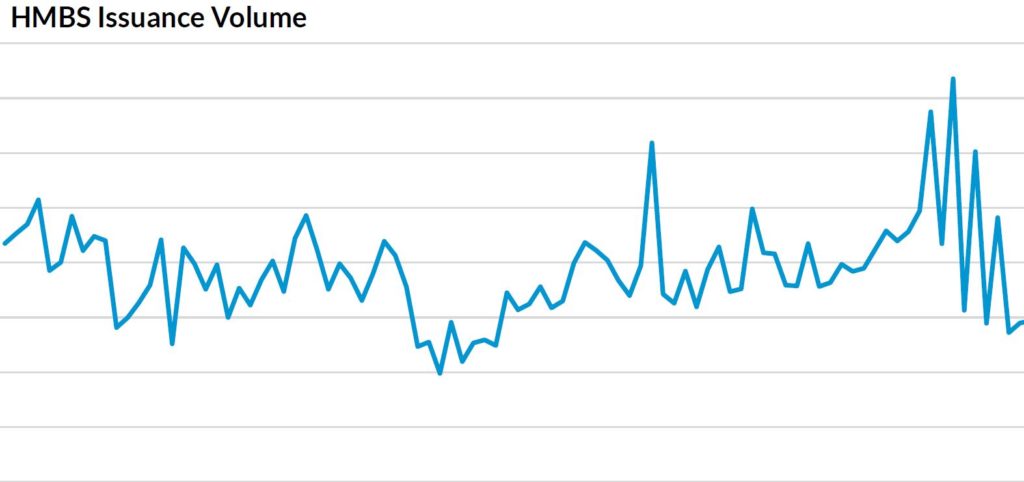

HMBS May 2024: May The Force Be With You

The HMBS new issue market continued to inch up in May. HECM Mortgage-Backed Securities (“HMBS”) issuance totaled $526 million in May, $23 million higher than April’s $503 million. … more HMBS May 2024: May The Force Be With You

GNMA Expands ESG Disclosures to HMBS Pools

Ginnie Mae announced an additional expansion of its Low-to-Moderate Income (LMI) disclosure initiative to include pool-level data for its HECM Mortgage-Backed Securities (HMBS) program. Ginnie Mae’s new HMBS … more GNMA Expands ESG Disclosures to HMBS Pools

Ginnie Mae Adopts Cybersecurity Notification Requirement

Ginnie Mae has implemented Cybersecurity Incident reporting requirements as part of its continued commitment to the security and integrity of all operational systems and critical technology infrastructure related … more Ginnie Mae Adopts Cybersecurity Notification Requirement