Ginnie Mae is exploring a new securitization option that would allow HECMs with balances above 98 percent of FHA’s Maximum Claim Amount to be pooled into securities. Yes, … more GNMA Exploring Enhancements to HMBS Program

Secondary Markets

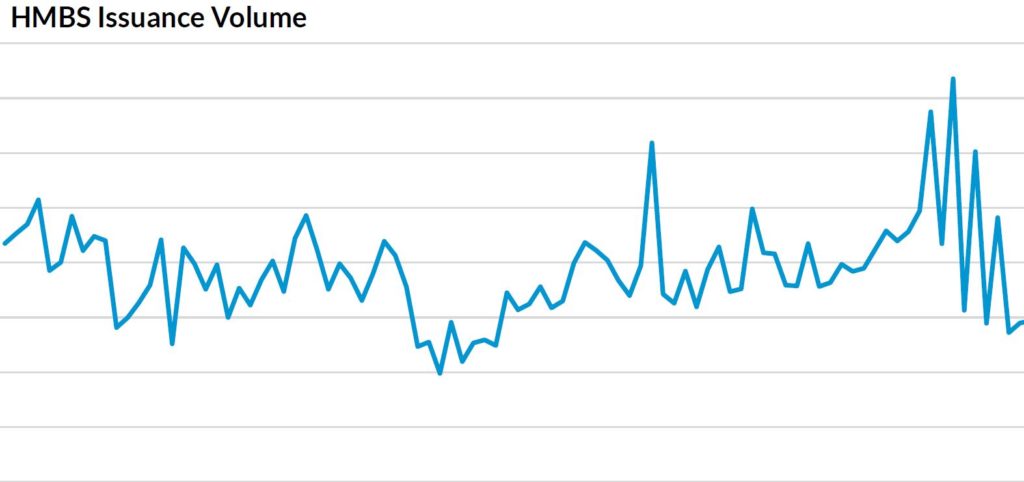

GNMA Annual Report Highlights HMBS Achievements

Ginnie Mae published its Fiscal Year 2023 Annual Report to highlight its programs and accomplishments from the past year, including steps taken to alleviate liquidity pressures that impacted … more GNMA Annual Report Highlights HMBS Achievements

Ginnie Mae Updates HMBS Pooling Eligibility Requirements

To help alleviate the ongoing liquidity pressures felt by HMBS issuers, Ginnie Mae last week updated its pooling requirements to allow for multiple participations related to a particular … more Ginnie Mae Updates HMBS Pooling Eligibility Requirements

BPC Interviews Ginnie Mae President Alanna McCargo

The Bipartisan Policy Center this week conducted a fireside chat with Ginnie Mae President Alanna McCargo. The event coincided with the recent anniversary of the signing of the … more BPC Interviews Ginnie Mae President Alanna McCargo

Former GNMA President Offers Way to Protect Issuer Liquidity

Ted Tozer, the president of Ginnie Mae from 2010 to 2017 and now a nonresident fellow at the Urban Institute, authored a white paper that offers a way to enhance … more Former GNMA President Offers Way to Protect Issuer Liquidity

Ginnie Mae Issues LIBOR Transition Guidance

Ginnie Mae published guidance for issuers on the transition of all outstanding HECM Mortgage-Backed Securities tied to the London Interbank Offered Rate (LIBOR) to the Secured Overnight Financing … more Ginnie Mae Issues LIBOR Transition Guidance

FHA Finalizes Policies to Expedite HECM Assignments

The Federal Housing Administration published Mortgagee Letter 2023-10 to allow for faster payment of funds to mortgagees when they assign a Home Equity Conversion Mortgage to HUD. Effective immediately, ML 2023-10: … more FHA Finalizes Policies to Expedite HECM Assignments

Joint Statement On Completing the LIBOR Transition

The Consumer Financial Protection Bureau issued a joint statement with four other federal regulatory agencies, and state bank and credit union regulators, as a reminder that use of … more Joint Statement On Completing the LIBOR Transition

FHA Proposes Changes to HECM Assignment Claims Submission Process

By Weiner Brodsky Kider and NRMLA staff On April 4, 2023, FHA posted a draft Mortgagee Letter (ML) that would make changes to the HECM Assignment Claim Type 22 submission … more FHA Proposes Changes to HECM Assignment Claims Submission Process

HMBS February 2023 Part II: Waiting For Issuer 43

HMBS payoffs remained low in February, as Mandatory Purchases continued to rise and natural payoffs remained at less than a 7% per annum rate. February payoffs totaled about … more HMBS February 2023 Part II: Waiting For Issuer 43