The Federal Housing Administration implemented a new phishing-resistant multi-factor authentication (MFA) for its FHA Connection (FHAC) system. The phishing-resistant MFA is available now to all FHAC users and … more FHA Implements Multifactor Authentication for FHA Connection

HUD

FHA Implements Mandatory Multi-Factor Authentication for FHAC Users

The Federal Housing Administration announced in FHA Info #2025-23 that it has implemented a new phishing-resistant multi-factor authentication for its FHA Connection (FHAC) system. Users must implement the … more FHA Implements Mandatory Multi-Factor Authentication for FHAC Users

HUD Introduces FHA Catalyst Partner Environment

This week, the Federal Housing Administration announced in FHA Info 2025-19 the availability of the Catalyst Partner Environment, a new Application Programming Interface (API) testing platform designed to … more HUD Introduces FHA Catalyst Partner Environment

FHA Rescinds Anti-Discrimination Appraisal Policies

The Federal Housing Administration rescinded three mortgagee letters that had sought to reduce discrimination in the appraisal process but which the Trump administration argued had created barriers and … more FHA Rescinds Anti-Discrimination Appraisal Policies

NRMLA Asks HUD to Extend ORCA Initiative to HECM

NRMLA has asked the Department of Housing and Urban Development to consider extending its Optional Reimbursement Claim Alternative (ORCA) to the HECM program. Earlier this year, HUD published … more NRMLA Asks HUD to Extend ORCA Initiative to HECM

HUD Extends Foreclosure Relief to CA Homeowners

The Department of Housing and Urban Development announced a 90-day extension of its foreclosure moratorium on FHA-insured mortgages, including HECMs, for areas of Los Angeles County devastated by … more HUD Extends Foreclosure Relief to CA Homeowners

FHA Issues Waivers of Construction Flood Elevation Requirements

The Federal Housing Administration announced in FHA Info 2025-10 that it was issuing a temporary partial regulatory waiver and related Single Family Housing Policy Handbook 4000.1 (Handbook 4000.1) … more FHA Issues Waivers of Construction Flood Elevation Requirements

HUD IG Issues Reverse Mortgage Bulletin

The Fraud Bulletin was published in response to the recent criminal conviction of Mark Diamond, a Chicago-based contractor who orchestrated a home repair and reverse mortgage fraud scheme … more HUD IG Issues Reverse Mortgage Bulletin

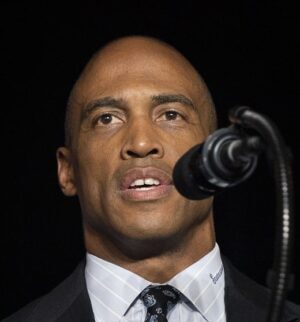

NRMLA Signs Letter of Support for HUD Secretary Nominee

NRMLA, along with 22 other advocacy groups, co-signed a letter asking members of the Senate Banking Committee to approve the nomination of Scott Turner as the next Secretary … more NRMLA Signs Letter of Support for HUD Secretary Nominee

Advice on Handling HECMs in Disaster Areas

The devastating fires in Los Angeles County prompted the Federal Housing Administration to publish FHA Info #2025-07 as a reminder to mortgagees about its guidance for servicing and … more Advice on Handling HECMs in Disaster Areas