HMBS payoffs remained low in February, as Mandatory Purchases continued to rise and natural payoffs remained at less than a 7% per annum rate. February payoffs totaled about $800 million, the fourth lowest payoff amount in nearly 6 years. Outstanding HMBS fell slightly to a record $59.8 billion due to the drop in issuance.

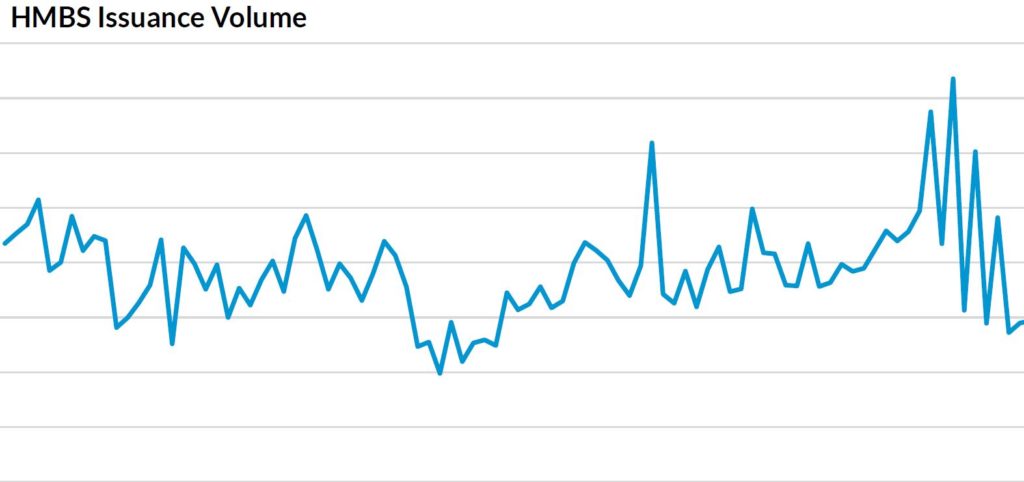

Higher interest rates finally caught up with the HMBS market in 2022, driving down Principal Limit Factors (initial loan-to-value ratios or “PLFs”) sharply. Big trouble came in the fourth quarter. In October, the trend of declining home prices became more clear and widespread. In November, Reverse Mortgage Funding (“RMF”), holder of the largest HMBS servicing portfolio, declared bankruptcy. In December, AAG, the top HECM originator, agreed to sell its assets to Finance of America Reverse, taking another major HMBS issuer out of the picture.

Also in December, Ginnie Mae took over RMF’s HMBS portfolio. In Ginnie Mae’s recent data release, “Ginnie Mae – Reverse Mortgage Funding 42” is now shown as the issuer of record for the 4,052 former RMF pools. About $300 million of Issuer 42’s portfolio paid off in February. “Issuer 42” HMBS accounts for just under $21 billion, or about 34% of all outstanding HMBS.

Issuer 42 is not issuing any tail pools. After nearly three months, we estimate Issuer 42 has an approximate $300 million uncertificated position, that is, the excess of their HECM balance over their HMBS balance. Is there an “Issuer 43” waiting in the wings to take over this portfolio? Or will it be a big melting iceberg, like Fannie Mae’s HECM portfolio, which has dwindled from $75 billion to approximately $5 billion today, more than a decade after Fannie bought her last HECM. Only time will tell.

The lending limit/MCA was raised to $1,089,300 in 2023; it remains to be seen if this will slow the steady decline in industry volume. Higher interest rates and slowing home price appreciation will challenge the HMBS market for the foreseeable future.

When a HECM loan balance reaches 98% of its MCA, the HMBS issuer is required to buy the loans out of the HMBS pool, and then may assign the loan to HUD if the loan is not in default. This is effectively a prepayment event for the HMBS investor, even though the underlying HECM loan remains outstanding. According to our friends at Recursion, 58% of HMBS payoffs last month were due to Mandatory Purchase, the highest percentage in 3 ½ years. Last month’s 98% MCA Mandatory Purchases totaled $450 million, the highest dollar total in over 3 years.

Including the Mandatory Purchases, HMBS paid off at a 15.2% annual rate in February, a slight uptick from January, which posted the slowest one-month rate since February 2016. Exclusive of Mandatory Purchases, the rate of HMBS payoffs has fallen significantly. HMBS payoffs resulting from underlying HECM loan payoffs, including payoffs due to mortality and refinancing, is less than 7%, a seven-year low and about one-third the rate of a year ago.

(Editor’s note: The following article was republished with permission from New View Advisors, which compiled this data from publicly available Ginnie Mae data as well as private sources.)