The Federal Housing Administration implemented a new phishing-resistant multi-factor authentication (MFA) for its FHA Connection (FHAC) system. The phishing-resistant MFA is available now to all FHAC users and … more FHA Implements Multifactor Authentication for FHA Connection

Reference Section

MISMO Releases Reverse Mortgage Origination Standards

MISMO®, the real estate finance industry’s standards organization, announced the new MISMO Version 3.6.1 Reference Model has reached “Candidate Recommendation” status, which means that they have been thoroughly … more MISMO Releases Reverse Mortgage Origination Standards

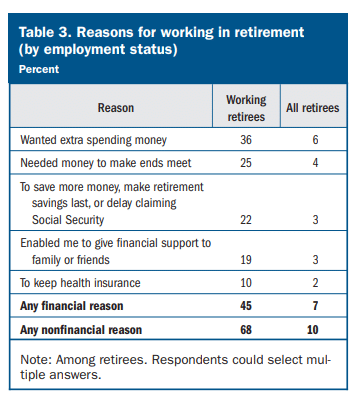

Federal Reserve Publishes Household Economic Well-Being Report

The Federal Reserve Board published its “Economic Well-Being of U.S. Households in 2024” report, which examines the financial circumstances of U.S. adults and their families.The report draws from … more Federal Reserve Publishes Household Economic Well-Being Report

Member Spotlight: Renee Duval, Bookend Lending, LLC

To help our members get to know one another, NRMLA publishes periodic member spotlights featuring professionals from across the reverse mortgage ecosystem. Meet Renee Duval, a loan officer … more Member Spotlight: Renee Duval, Bookend Lending, LLC

Key Takeaways on Trusts and HECMs

Thank you to everyone who participated in last week’s webinar on trusts, POAs, conservatorships, and life estates. Education Committee Co-Chair Chris Downey interviewed trust attorney Paul Lovegrove for … more Key Takeaways on Trusts and HECMs

Why Proprietary Reverse Mortgages Matter

Proprietary reverse mortgages have been around for years, but they’ve become increasingly more important to the future growth of the reverse mortgage industry because of the innovative ways … more Why Proprietary Reverse Mortgages Matter

Financial Planning Association Publishes Retirement Readiness Report

The Financial Planning Association®—with support from Finance of America—released the 2025 Trends in Retirement Planning survey report, which provides a look at the evolving challenges and priorities shaping … more Financial Planning Association Publishes Retirement Readiness Report

Edelman Survey Yields Interesting Retirement Perspectives

A new survey conducted by investment advisory firm Edelman Financial Engines reinforces a trend in how Americans think about retirement: specifically, they imagine these years to be more … more Edelman Survey Yields Interesting Retirement Perspectives

Loan Originators Share Sales Best Practices

The Loan Officer Roundtable held during the recent Western Regional Meeting in Irvine offered a goldmine of best practices that can help loan originators close more loans. Moderator … more Loan Originators Share Sales Best Practices

Servicing Corner: Understanding Insurance Claims and Reverse Mortgages

In the wake of the devastating wildfires in Southern California, it’s essential for industry professionals and reverse mortgage borrowers to understand how insurance claims work for properties with … more Servicing Corner: Understanding Insurance Claims and Reverse Mortgages