The Federal Reserve Board published its “Economic Well-Being of U.S. Households in 2024” report, which examines the financial circumstances of U.S. adults and their families.

The report draws from the Board’s annual Survey of Household Economics and Decision-Making (SHED), which was fielded in October 2024, and includes feedback on retirement preparedness and challenges facing homeowners and retirees.

Highlights:

- 73 percent of adults say they’re doing okay or living comfortably financially, which was similar to the 72 percent seen in 2023 but down from the recent high of 78 percent in 2021.

- Inflation and prices continued to be the top financial concern, particularly the prices of food and groceries.

- Sixty-three percent of adults said they would cover a hypothetical $400 emergency expense exclusively using cash or its equivalent, unchanged from 2022 and 2023 but down from a high of 68 percent in 2021.

- Progress toward retirement savings goals improved slightly in 2024. Thirty-five percent of non-retirees thought their retirement savings plan was on track, up from 2022 and 2023, but down from 40 percent in 2021.

- About 2 in 10 adults said they were affected financially by a natural disaster in the prior year, including 8 percent who were moderately or severely affected. Property damage was the most common way people were affected.

- Seven percent of homeowners did not have homeowners insurance, most often because of cost. When asked the main reason they didn’t have homeowners insurance, 43 percent said they “couldn’t afford it,” while another 19 percent said “it is not worth the cost.”

- Collectively, health problems, caring for family, and lack of work contributed to the timing of retirement for 42 percent of retirees.

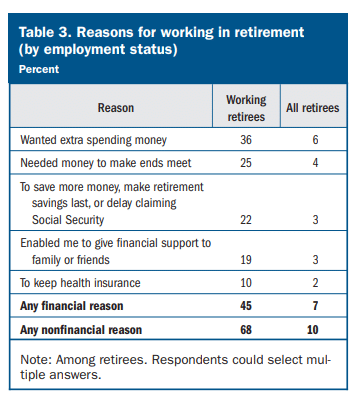

- One in ten retirees said they worked, at least in part, for non-financial reasons such as having a sense of purpose and enjoying social connections, whereas 7 percent gave financial reasons. Four percent said they were working for both financial and non-financial reasons.