The U.S. Senate Special Committee on Aging released a bipartisan report that examines the real-time information and help older Americans and people with disabilities need as they face changes in their lives, known as “just-in-time” financial literacy.

The committee held a virtual hearing on January 13 to discuss the topic and the report itself, titled “Financial Literacy in Retirement: Providing Just-in-Time Information and Assistance to Older Americans and People with Disabilities.”

The report identifies six common decisions that require, and can benefit from, this kind of financial literacy: claiming Social Security, enrolling in Medicare, annuitizing a 401(k), giving to charity, downsizing a home and responding to a natural disaster.

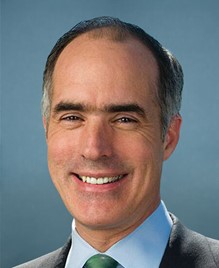

“This year, more than 10,000 Americans will turn 65 every day. Around kitchen tables all across the country, retirees and seniors are asking: ‘Should I take my Social Security or should I wait?’ and ‘Do I need to sign up for Medicare, or can I wait?’ These are not simple decisions,” said Senator Bob Casey (D-PA) (pictured), chairman of the Senate Special Committee on Aging. “As we begin 2022, I urge seniors to make a New Year’s resolution: take stock of your finances and get prepared for these upcoming decisions.”