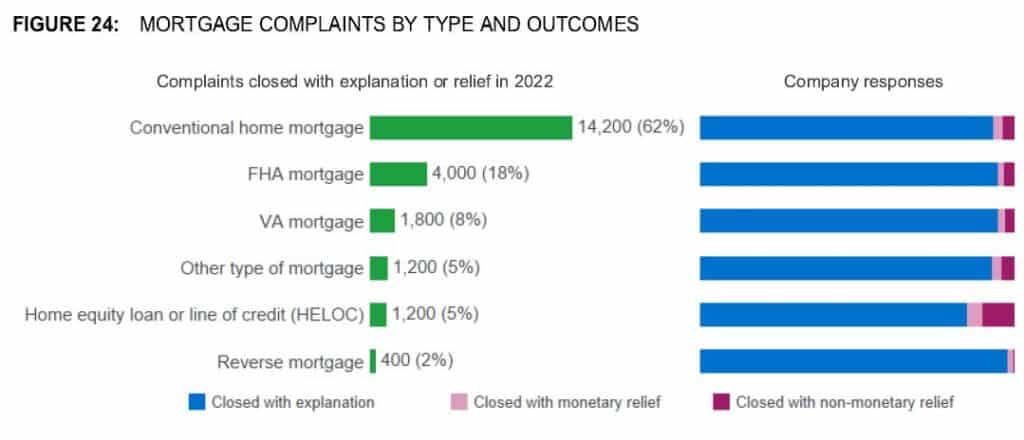

Out of 27,99 mortgage-related complaints submitted to the Consumer Financial Protection Bureau in 2023, approximately 400, or two percent, were brought against reverse mortgage companies, according to the CFPB’s Consumer Response Annual Report.

This represents the same number of reverse mortgage complaints submitted the prior year.

Go deeper: No specific details were provided about the nature of the reverse mortgage complaints.

- However, the report noted challenges that all mortgage borrowers had communicating with the companies servicing their loans.

- Common servicing issues involved loss mitigation, payment, and escrow issues.