On December 12, 2024, House Republican leaders selected Rep. French Hill (R-AR) to chair the House Financial Services Committee in the 119th Congress. What’s next: The House Republican Conference … more Rep. French Hill Chosen to Lead Financial Services Committee

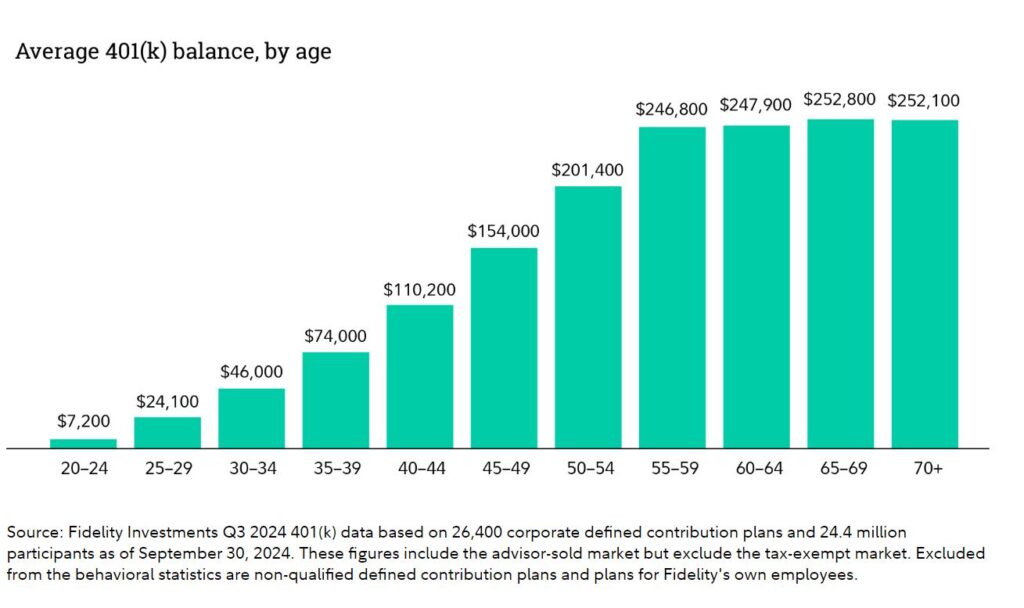

Fidelity Examines 401(k) and IRA Balances By Generation

An analysis of 401(k) and IRA accounts managed by Fidelity Investments found that Baby Boomers on average have saved $250,900 in their workplace 401(k) and $250,966 in an Individual Retirement … more Fidelity Examines 401(k) and IRA Balances By Generation

Agencies Issue Statement on Elder Financial Exploitation

Federal and state financial regulators and the Financial Crimes Enforcement Network (FinCEN) issued a statement that offers best practices for combatting elder financial exploitation. Why it matters: A … more Agencies Issue Statement on Elder Financial Exploitation

Transamerica Survey Highlights Positive Parts of Retirement and Challenges

A new study — titled “Retiree Life in the Post-Pandemic Economy” — examines the health and well-being, personal finances, and retirement security of U.S. residents who are retired … more Transamerica Survey Highlights Positive Parts of Retirement and Challenges

Mortgagees Have 36 Hours to Report Cyber Incidents

Effective immediately, Mortgagee Letter 2024-23 requires mortgagees to notify the Department of Housing and Urban Development as soon as possible — but no later than 36 hours — … more Mortgagees Have 36 Hours to Report Cyber Incidents

HECM Loan Limit Increasing to $1,209,750 in 2025

The Federal Housing Administration has just announced that it will increase the maximum claim amount for Home Equity Conversion Mortgages in calendar year 2025 from $1,149,825 to $1,209,750, … more HECM Loan Limit Increasing to $1,209,750 in 2025

Ginnie Mae Finalizes HMBS 2.0 Term Sheet

Ginnie Mae published a finalized term sheet for its HECM Mortgage-Backed Securities (HMBS) 2.0 program. The final term sheet was developed in response to comments received and subsequent engagement with … more Ginnie Mae Finalizes HMBS 2.0 Term Sheet

Valverde Resigning as Acting Ginnie Mae President

Ginnie Mae announced last week that Acting President Sam Valverde will be stepping down effective November 30, 2024. Senior Vice President and Chief Risk Officer Gregory Keith will … more Valverde Resigning as Acting Ginnie Mae President

America’s 30 Safest and Wealthiest Retirement Towns

GoBankingRates.com ranked America’s safest and wealthiest retirement towns based on violent and property crime statistics, average retirement income for persons aged 65+, property values and a livability score. … more America’s 30 Safest and Wealthiest Retirement Towns

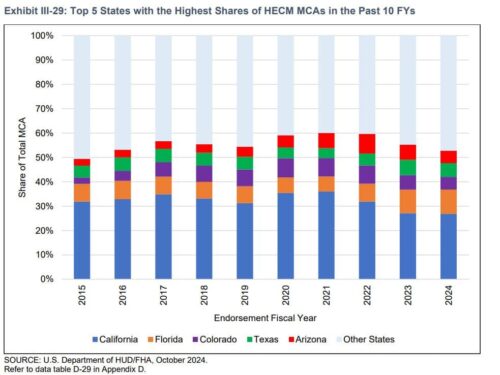

Highlights From FHA’s Annual Report to Congress

For a fourth consecutive year, the Home Equity Conversion Mortgage portfolio had a positive economic value. That’s according to the Department of Housing and Urban Development’s 2024 Annual … more Highlights From FHA’s Annual Report to Congress