A new study — titled “Retiree Life in the Post-Pandemic Economy” — examines the health and well-being, personal finances, and retirement security of U.S. residents who are retired … more Transamerica Survey Highlights Positive Parts of Retirement and Challenges

Retirement Issues and Trends

America’s 30 Safest and Wealthiest Retirement Towns

GoBankingRates.com ranked America’s safest and wealthiest retirement towns based on violent and property crime statistics, average retirement income for persons aged 65+, property values and a livability score. … more America’s 30 Safest and Wealthiest Retirement Towns

How AI Can Help Modernize Pension and Retirement Systems

The world is going through a seismic demographic transition, as populations age and traditional workforces shrink, prompting challenges for retirement systems that need to adapt to remain resilient. … more How AI Can Help Modernize Pension and Retirement Systems

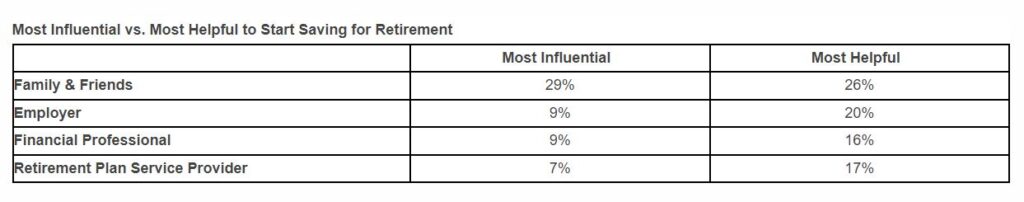

Survey: 77 Percent of Middle-Income Households Actively Save for Retirement

A new survey published by global financial services firm Principal Financial Group reveals strong retirement savings habits among middle-income households earning between $50,000-$99,999 annually. By the numbers: Seventy-seven … more Survey: 77 Percent of Middle-Income Households Actively Save for Retirement

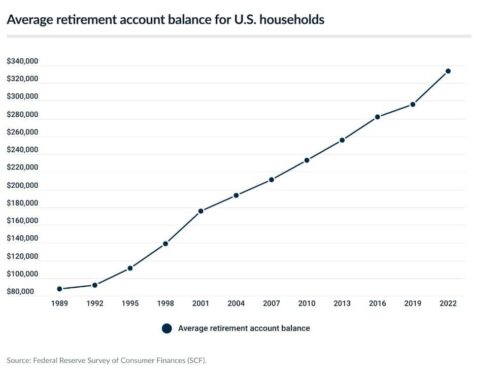

Noteworthy 2024 Retirement Statistics

DepositAccounts, a personal finance web site affiliated with LendingTree, reported that the average 401(k) balance in the second quarter of 2024 was $127,100, while the average Individual Retirement … more Noteworthy 2024 Retirement Statistics

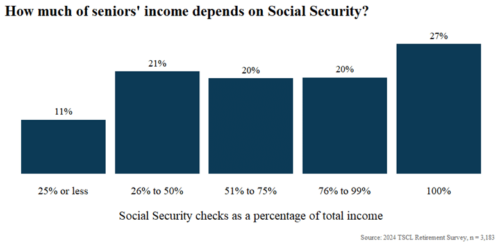

Two-Thirds of Seniors Rely on Social Security for More Than Half Their Income

A survey conducted by The Senior Citizens League, a non-profit that advocates for increased Social Security benefits, found that 27 percent of older Americans rely solely on Social … more Two-Thirds of Seniors Rely on Social Security for More Than Half Their Income

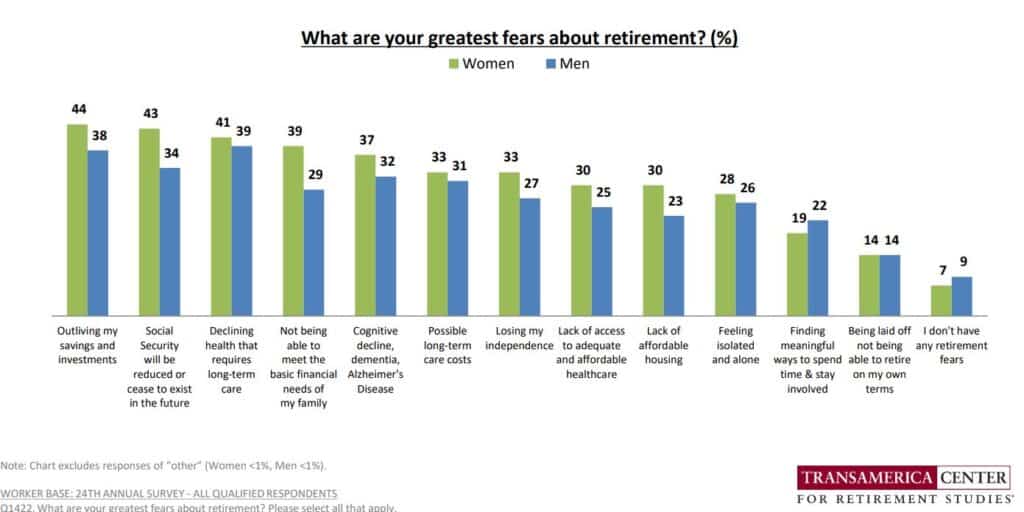

Women Believe They Need This Amount to Retire

The survey conducted by the Transamerica Center for Retirement Studies finds that women workers believe they will need to have saved $500,000 by the time they retire to … more Women Believe They Need This Amount to Retire

Treasury Stresses SECURE 2.0 in Financial Inclusion Plan

To help foster financial well-being for all, but especially lower-income and minority households, the U.S. Department of the Treasury released a report commissioned by Congress that recommends federal … more Treasury Stresses SECURE 2.0 in Financial Inclusion Plan

Public Employees Share Retirement Concerns

A national survey of public employees from MissionSquare Research Institute reveals the vast majority (81 percent) are concerned they won’t have enough money to last throughout their retirement … more Public Employees Share Retirement Concerns

States Make Case for Why Auto-IRAs Make Fiscal Sense

The Pew Charitable Trusts estimates that by the end of 2040 insufficient retirement savings will have cost states and the federal government a combined $1.3 trillion in increased … more States Make Case for Why Auto-IRAs Make Fiscal Sense