HMBS issuance totaled $872 million in February 2021, as the LIBOR deadline finally arrived. February 2021 was the last month in which Ginnie Mae allowed pooling of new HMBS pools backed by first participations of LIBOR-based HECMs. 92 pools were issued in February; of these, 17 pools totaling $224 million were pools backed by new LIBOR loans.

February also saw strong issuance of HMBS backed by new CMT-indexed loans; 27 pools totaling just under $418 million were issued in this category. Before January 2021 no new first-participation CMT pools had been issued in many years.

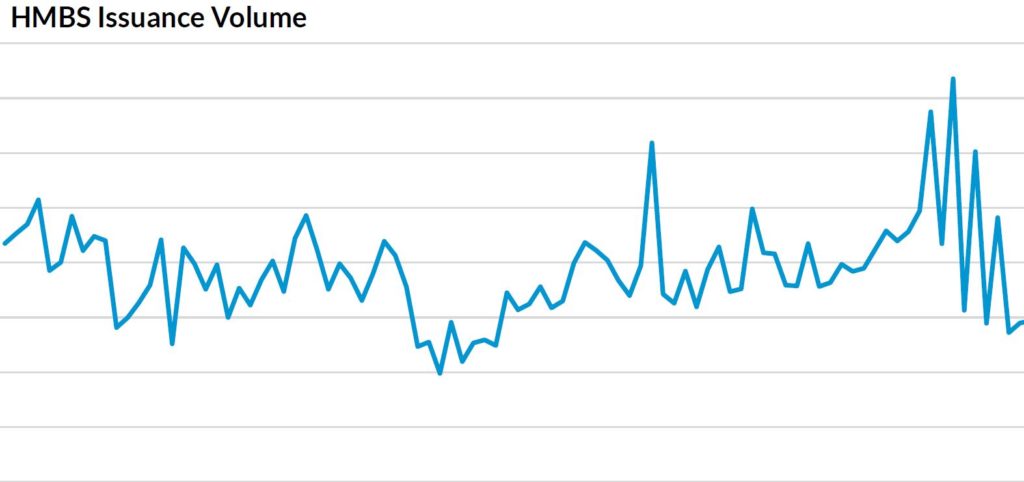

A record $10.6 billion in HMBS was issued in 2020, easily beating 2019’s total of $8.3 billion, 2018’s $9.6 billion, and even eclipsing the $10.5 billion set in 2017. 2010 remains the all-time HMBS volume year with $10.8 billion issued, when Principal Limits were high and no borrower financial assessment safeguards had been established. HMBS issuers will be hard pressed to equal last year’s total, but now that the LIBOR deadline has passed, the reverse mortgage picture should soon become clear.

February production of original new loan pools was $693 million, up from January’s $552 million, but significantly down from December’s record $878 million and November’s $765 million. Approximately $501 million in original new loan pools were issued in February 2020.

February issuance divided into 50 first-participation or original pools, and 42 tail pools. Original pools are those HMBS pools backed by first participations in previously uncertificated HECM loans. Tail HMBS issuances are HMBS pools consisting of subsequent participations. Tails are not from new loans, but they do represent new amounts lent. Tail HMBS issuance is essential for HMBS issuers to finance their monthly advances, such as borrower draws, FHA mortgage insurance premiums, etc. Last month’s tail pool issuances totaled $180 million, below the typical $200-$250 million range.

Helped by low interest rates, low default rates, and the reemergence of private loans, the reverse mortgage market appears strong. However, this strength could be challenged by economic conditions, rising interest rates and the transition out of LIBOR. The Constant Maturity Treasury “CMT” index is now the only index for new adjustable rate HECM loans and will remain so until transition to another index, likely the Secured Overnight Financing Rate “SOFR,” occurs.

(Editor’s note: The following article was republished with permission from New View Advisors, which compiled this data from publicly available Ginnie Mae data as well as private sources.)