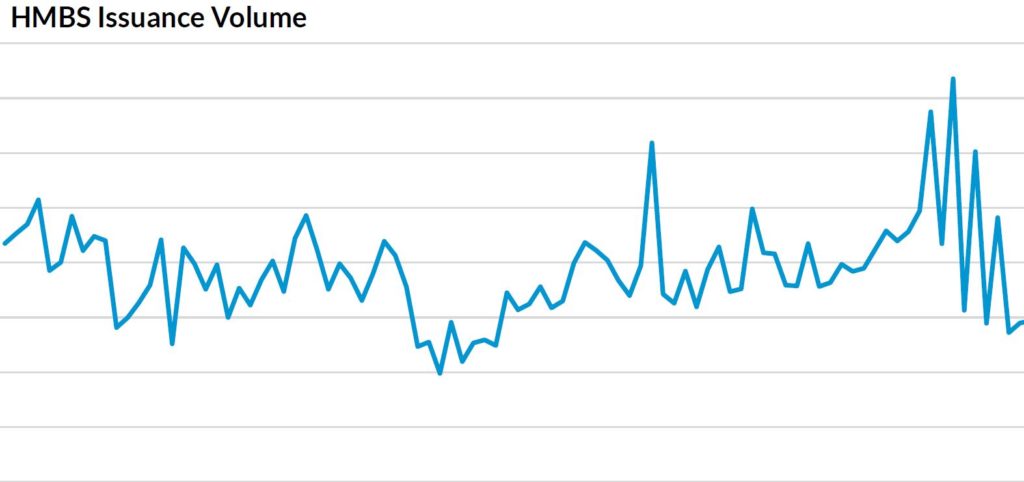

HMBS issuers posted another strong month in July with just over $1.1 billion in new issuance, as refinancing activity continued to be strong. 106 pools were issued in July, including 43 first-participation CMT pools. Before January 2021 no new first-participation CMT pools had been issued for many years.

The all-time HMBS annual volume year is 2010, with $10.8 billion issued. That was when Principal Limits were high and no borrower financial assessment safeguards had been established. That record may fall this year, as over $7 billion was issued in the first seven months, but it remains to be seen how long the refinancing boom can continue.

July’s production of original new loan pools was a record $937 million, compared to June’s $823 million, May’s $862 million, April’s previous record $900 million, March’s $671 million, February’s $693 million, January’s $552 million, December’s $878 million, and November’s $765 million. Approximately $691 million in original new loan pools were issued in July 2020.

July issuance divided into 53 first-participation or original pools, and 53 tail pools. Original pools are those HMBS pools backed by first participations in previously uncertificated HECM loans. Tail HMBS issuances are HMBS pools consisting of subsequent participations. Tails are not from new loans, but they do represent new amounts lent. Tail HMBS issuance is essential for HMBS issuers to finance their monthly advances, such as borrower draws and FHA mortgage insurance premiums. Last month’s tail pool issuances totaled $203 million, within the typical range.

(Editor’s note: The following article was republished with permission from New View Advisors, which compiled this data from publicly available Ginnie Mae data as well as private sources.)