Two new reports from the National Council on Aging examine how home equity can impact cash flow and enable more older adults to age in place.

Both reports were authored by Barb Stucki, whose extensive career has centered on helping older Americans manage the financial challenges of aging, and LeadingAge LTSS Center @UMass Boston.

The first report – Cash Flow Challenges and Homeownership in Later Life – examines cash flow using the Elder Index to assess whether 62+ households have adequate income to cover their bills. The report notes, “Those who have housing wealth could buffer against a destabilizing financial shock with a home equity loan. A reverse mortgage can also help, since these loans further improve cash flow by eliminating the need to make monthly mortgage payments.”

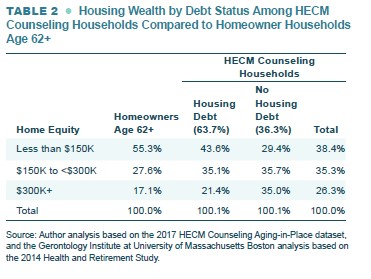

The second report – Using Home Equity to Sustain Cash Flow for Aging-in-Place – looks at cash flow challenges using data from 70,089 Home Equity Conversion Mortgage (HECM) counseling sessions conducted in 2017 and then compares those findings with 62+ households in the general population. Among the key findings:

- 67.8 percent of all HECM counseling households considered a HECM for debt reduction. About two thirds (63.7 percent) had existing housing debt, versus 29.4 percent of homeowner households ages 62 and older in the general population;

- 11.9 percent had no debt and intended to use a HECM to help cover daily expenses. In this group, 42.6 wanted to increase their quality of life, and 36 percent wanted to make home repairs or renovations; and

- One in ten households considering a HECM (9.6 percent) had no apparent cash flow challenges, nor were they economically insecure.