Despite six in ten employed U.S. workers (60 percent) having made adjustments due to pandemic-related financial strain, 82 percent are still saving for retirement, including 84 percent of Baby Boomers, according to new research from the Transamerica Center for Retirement Studies®.

Titled Living in the COVID-19 Pandemic: The Health, Finances, and Retirement Prospects of Four Generations, the report was published as part of TCRS’ 21st Annual Retirement Survey of Workers, one of the largest and longest-running surveys of its kind.

Other highlights:

- Almost two-thirds of workers (64 percent) indicate their confidence in their ability to retire comfortably has stayed the same in light of the pandemic, including 76 percent of Baby Boomers;

- Seventy-three percent of workers are confident that they will be able to fully retire with a comfortable lifestyle, while 24 percent of Baby Boomers are “very” confident;

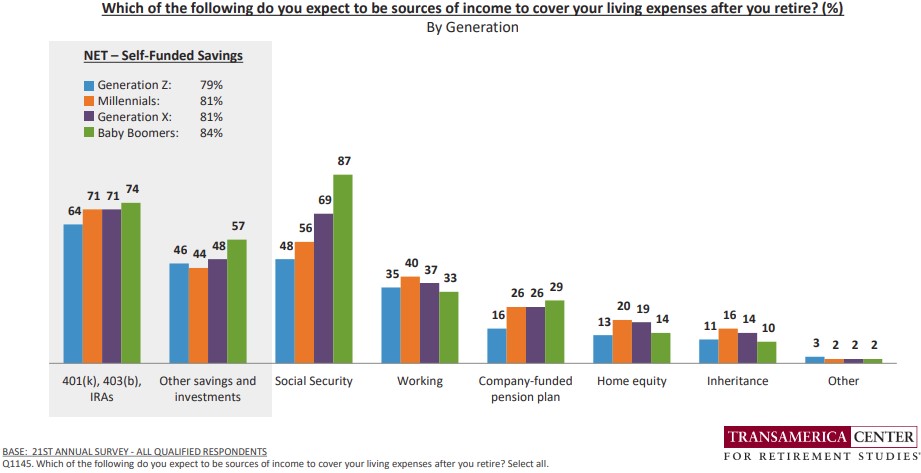

- Eighty-two percent of workers expect self-funded savings to be sources of retirement income, including 401(k), 403(b), and IRAs (71 percent) and/or other savings and investments (48 percent). Fewer than one in five workers are expecting retirement income from home equity (18 percent) or an inheritance (14 percent);

- Baby Boomers (34 percent) are more likely to expect Social Security to be their primary source of income in retirement, compared with Generation X (23 percent), Millennials (14 percent), and Generation Z (12 percent); and

- Total household retirement savings among all workers is $93,000 (estimated median). Baby Boomer workers have the most retirement savings at $202,000, compared with Generation X ($107,000), Millennials ($68,000), and Generation Z ($26,000) (estimated medians).