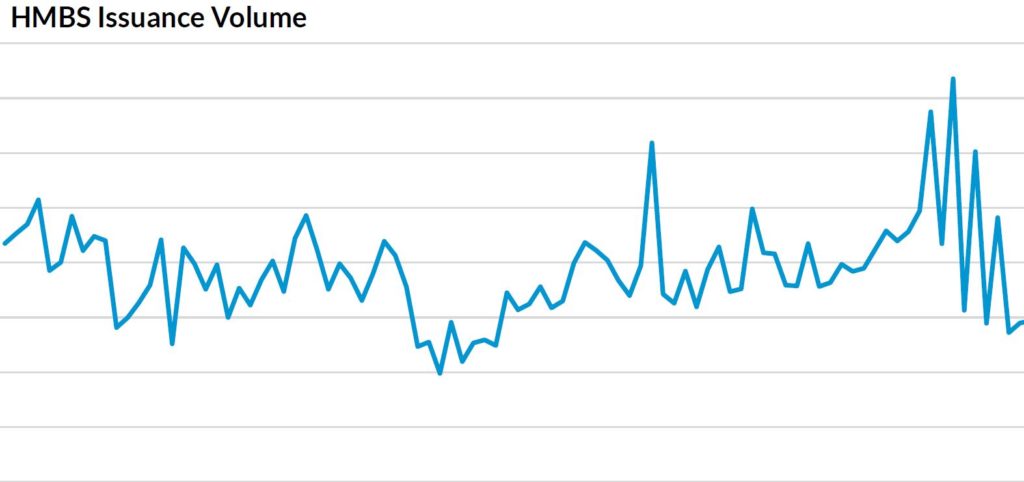

HMBS issuers posted record totals in September, with the highest monthly issuance volume this year, and another record for new loan pools. They issued just over $1.2 billion in new HMBS, as refinancing activity continued to be strong. 107 pools were issued in September, including 47 first-participation CMT pools. Before January 2021 no new first-participation CMT pools had been issued for many years.

The all-time HMBS annual volume year is 2010, with $10.8 billion issued. That was when Principal Limits were high and no borrower financial assessment safeguards had been established. That record will fall this year, as nearly $9.3 billion was issued in the first nine months.

September’s production of original new loan pools was a record $1.03 billion, easily surpassing August’s $880 million, July’s previous-record $937 million, June’s $823 million, May’s $862 million, April’s $900 million, March’s $671 million, February’s $693 million, and January’s $552 million. Approximately $693 million in original new loan pools were issued in September 2020.

September issuance divided into 60 first-participation or original pools, and 47 tail pools. Original pools are those HMBS pools backed by first participations in previously uncertificated HECM loans. Tail HMBS issuances are HMBS pools consisting of subsequent participations. Tails are not from new loans, but they do represent new amounts lent. Tail HMBS issuance is essential for HMBS issuers to finance their monthly advances, such as borrower draws and FHA mortgage insurance premiums. Last month’s tail pool issuances totaled $189 million, within the typical range.

(Editor’s note: The following article was republished with permission from New View Advisors, which compiled this data from publicly available Ginnie Mae data as well as private sources.)