Outstanding HMBS rose to a record $56.8 billion in October 2021, as high levels of both issuance and HECM loan payoffs continued. HMBS payoffs exceeded $1 billion for the eighth month in a row. Outstanding HMBS rose by about $90 million. These big numbers, very similar to September’s totals, reflect continued high levels of refinancing. Low interest rates and high home values allow more senior homeowners to borrow larger HECM loans.

Despite sharply declining refinance volume in the forward mortgage market, HECMs refinancing remains strong. According to multiple sources, refinancing accounts for as much as one half of new originations.

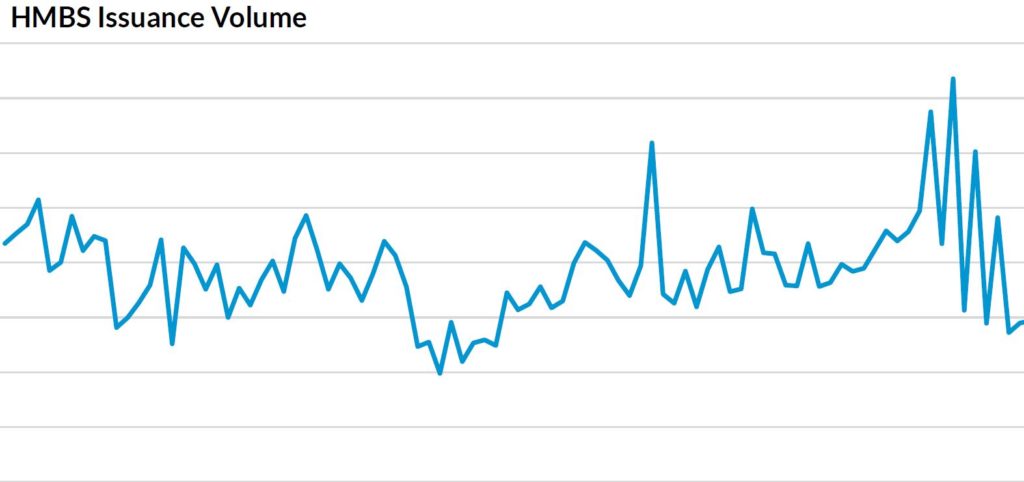

In 2019, HMBS posted its lowest annual issuance total in five years. But in 2020, low interest rates, rising home prices, and a higher lending limit boosted production significantly, to a near-record $10.6 billion. In the first ten months of 2021, HMBS new issuance already exceeds $10.4 billion.

Our friends at Recursion broke down the prepayment numbers further: last month’s 98% MCA mandatory purchases totaled $238 million, less than 20% of the total.

(Editor’s note: The following article was reprinted with permission from New View Advisors, which compiled this data from publicly available Ginnie Mae data as well as private sources.)