HMBS payoffs continued in April, as the refinancing wave diminished slightly but refused to ebb. Instead, April payoffs totaled $1.3 billion, just short of March 2022’s record $1.5 billion. Outstanding HMBS rose to a record $58 billion, with strong new issuance and a faster roll-up from rising interest rates.

HECM borrowers continue to refinance in large numbers, assisted by a higher HECM lending limit (now $970,800) and surging home prices (nearly 20% year-over-year, according to some measures). So far, rising interest rates have failed to calm reverse mortgage refinancings. The $1.3 billion in payoffs in April represents a 24% annual payoff rate.

However, April may be the beginning of the end of H2H refis. Given the lag between HECM loan origination and HMBS issuance, the new HECMs backing April’s HMBS pools do not fully reflect the rapid rise in interest rates over the past two months. The numbers for May and June will test the resilience of this refinancing wave, which began with lower interest rates but continued its momentum from the strong home price appreciation and higher FHA lending limits.

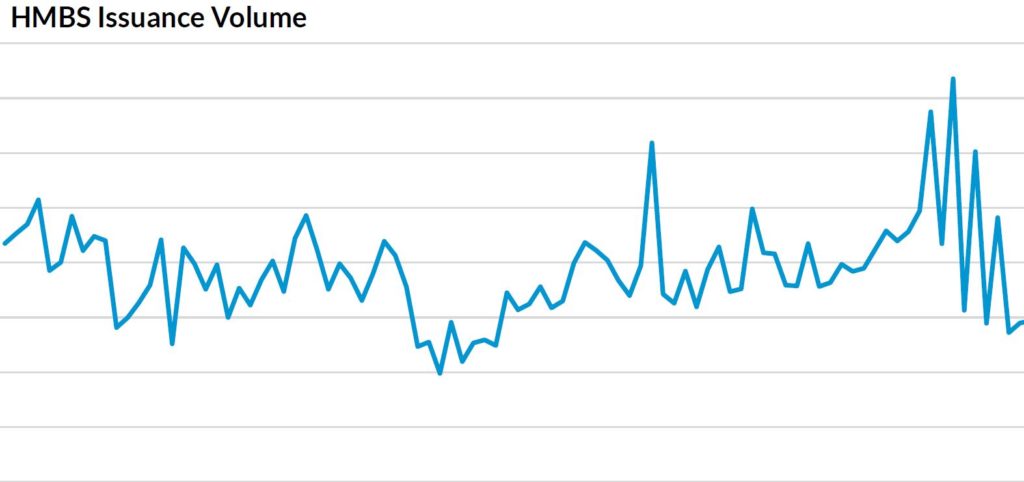

While 2021 surpassed all previous records with $13.2 billion HMBS issued, its record may yet fall: over $5.6 billion was issued in the first four months of 2022.

Our friends at Recursion broke down the prepayment numbers further: last month’s 98% MCA mandatory purchases totaled $256 million, 20% of the total.

(Editor’s note: The following article was republished with permission from New View Advisors, which compiled this data from publicly available Ginnie Mae data as well as private sources.)