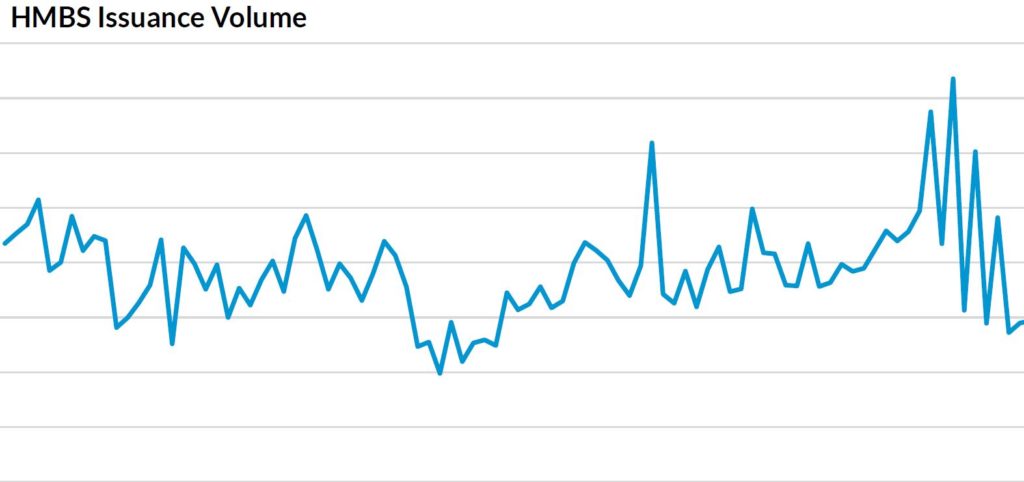

HECM Mortgage-Backed Securities (“HMBS”) issuance fell in May to $1.45 billion, down from April’s record $1.6 billion, as the refinancing wave finally began to ebb. However, production remains strong by historical standards.

Given the lag between HECM loan origination and HMBS issuance, new HECMs backing May’s HMBS pools do not fully reflect the rapid rise in interest rates over the past several months. The numbers for June and July issuance will test the resilience of these high levels of HECM loan production, which are sustained by lower interest rates, strong home price appreciation and higher FHA lending limits.

HMBS issuance totaled $13.2 billion for 2021, smashing the previous record set in 2010. With only five months in the books and over $7 billion issued, HMBS is on pace to set another new record in 2022.

May’s original (first participation) production fell to $1.2 billion, well below April’s record of $1.4 billion in new issuance, but exceeding March’s production of original new loan pools totaling $1.13 billion, February’s $1.12 billion and January’s $1.18 billion. Approximately $862 million in original new loan pools were issued a year ago, in May 2021.

103 pools were issued in May: 60 first-participation or original pools, and 43 tail pools. Original pools are those HMBS pools backed by first participations in previously uncertificated HECM loans. Tail HMBS issuances are HMBS pools consisting of subsequent participations. Tails are not from new loans, but they do represent new amounts lent. Tail HMBS issuance is essential for HMBS issuers to finance their monthly advances, such as borrower draws and FHA mortgage insurance premiums. Last month’s tail pool issuances totaled $211 million, within the typical range.

(Editor’s note: The following article was republished with permission from New View Advisors, which compiled this data from publicly available Ginnie Mae data as well as private sources.)