Housing wealth has increased 39 consecutive quarters, increasing from $10.1 trillion in early 2012 to a new peak of $26.3 trillion at the end of 2021, according to Harvard’s 2022 State of the Nation’s Housing report.

Home mortgage debt remained essentially flat over the past decade, dipping from $11.9 trillion in 2012 to a low of $11 trillion in 2014 before rising to $11.7 trillion at the end of last year.

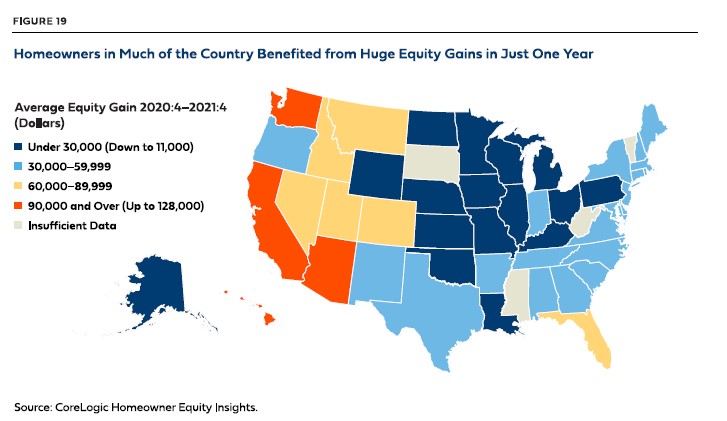

Individual homeowners saw their home equity double from $26,300 in 2020 to $55,300 in 2021. “This national number masks large differences across the country,” says the report, “with some of the biggest increases in states where rapid appreciation occurred on top of already high prices.”

Homeowners in Western states saw the largest dollar increase, ranging as high as $128,000 in Hawaii, $117,000 in California and $95,500 in Washington. The increases were smallest but still substantial in the Midwest, with a high of $33,000 in Indiana and a low of $17,000 in North Dakota.

The report also references Black Knight’s Mortgage Monitor, which says homeowners cashed out $275 billion in equity in 2021, the highest level since the peak of the previous housing boom in 2005. Read the full report.