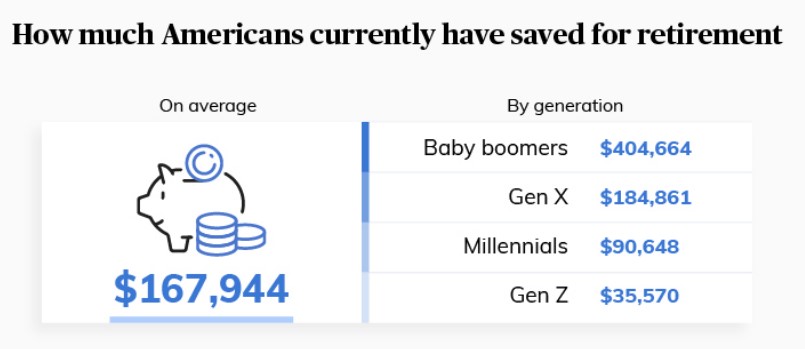

A recent survey of 1,000 Americans conducted by ConsumerAffairs found that the average amount saved for retirement across all age groups was $167,944, while Baby Boomers had the highest amount saved at $404,664.

Other key takeaways:

- 71% of Americans said they will rely on savings outside of their employer-provided retirement plan, while 64% will rely on their work retirement plan;

- Only 9% of Americans said they are not actively saving for retirement;

- 22% of Americans said they will rely on cryptocurrency investments for retirement;

- 66% of survey takers who fall within the Gen Z age group want to retire before the age of 60, and 56% believe they’re on track to do so; and

- Only 14% of retirees believe they’ve achieved their dream retirement situation, while 26% remain very worried about money. Read the full survey.