More than two-thirds (70%) of American retirees wished they had saved more and planned earlier for retirement, according to the 2022 Retiree Reflections Survey, published recently by the Employee Benefit Research Institute (EBRI).

The survey, which included responses from 1,109 retirees between the ages of 55 and 80 and a minimum of $50,000 in retirement assets, sought to understand use of financial plans, financial advisor use and assistance, priorities in retirement, spending concerns in retirement, financial worries pre-retirement and post-retirement and reflections upon past financial decisions.

Other highlights:

- Only 4 in 10 retirees surveyed had both identified financial goals in retirement and developed a written financial plan;

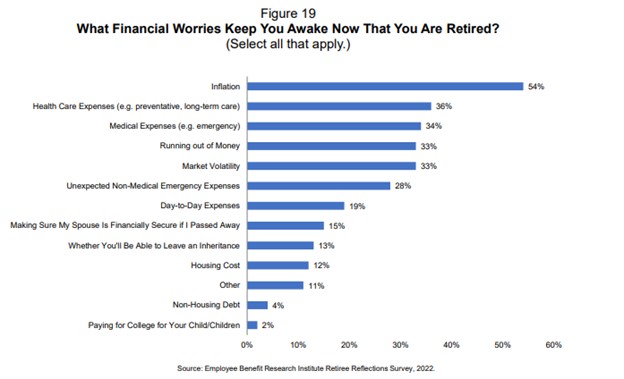

- Unexpected medical expenses and preventative health expenses were top financial concerns pre-retirement, while 54% of survey takers cited inflation as their top financial concern in retirement; and

- Only 25% of retirees reported that their former employer offered financial planning assistance, potentially reflecting a timing difference (benefits were offered after their employment tenure) or an awareness gap, revealing a need for improved communication. Read the full survey.