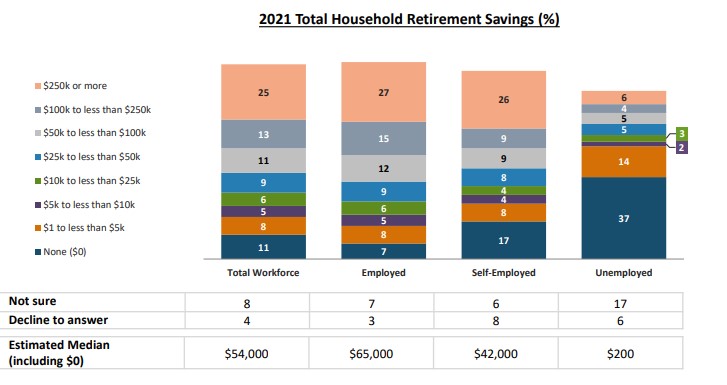

While 79% of employed workers are saving for retirement, 39% of them said they tapped their retirement accounts during COVID, including 29% who took a loan and 27% who claimed an early and/or hardship withdrawal. Total savings in household retirement accounts is $65,000 (estimated median).

That’s according to new research released by the Transamerica Center for Retirement Studies® (TCRS), titled Emerging From the COVID-19 Pandemic: The Retirement Outlook of the Workforce. As part of TCRS’ 22nd Annual Retirement Survey, one of the largest and longest-running surveys of its kind, the study delves into the impacts of the pandemic, including the health and financial well-being and retirement outlook of the workforce.

“Without doubt, the COVID-19 pandemic has disrupted the workforce and the employment of many workers. Employment setbacks often trigger financial setbacks that can easily threaten people’s ability to achieve a secure retirement,” said Catherine Collinson, CEO and president of Transamerica Institute and TCRS.

Survey highlights:

- 36% of workers were unemployed for various reasons at some point during the pandemic, and 38% experienced employment-related impacts ranging from reductions in hours and pay to layoffs and furloughs;

- 63% of employed workers indicate their financial situation has stayed the same amid the pandemic, while 22% say it worsened; and

- 68% of self-employed workers are saving for retirement, and they started saving at age 29 (median). Among them, 79% are saving in one or more types of tax-advantaged retirement account, with a traditional or Roth IRA being the most common (44 percent).