Buoyed by strong home price appreciation, the financial health of the Home Equity Conversion Mortgage portfolio dramatically improved in fiscal year 2022, ending September 30 with stand-alone capital ratio of 22.75 percent, compared to 6.08 percent the previous year, the Department of Housing and Urban Development announced this week in its 2022 Annual Report to Congress.

Put another way, the capital levels for the HECM portfolio improved by $11.3 billion over the past year from a positive $3.8 billion in FY2021 to a positive $15.1 billion in FY2022.

FHA’s forward mortgage program had a capital ratio of 10.47 percent in FY2022, while the overall capital ratio for the Mutual Mortgage Insurance Fund was 11.11 percent. Congress requires to operate at a minimum capital ratio of two percent.

“FHA’s Annual Report to Congress was welcome news and a clear-cut sign that programmatic reforms implemented by HUD to ensure the long-term sustainability of the HECM program continue to work, while also underscoring the strong leadership at FHA over the past two years,” says NRMLA President Steve Irwin. “That said, we continually look for ways to work with the Department to further improve the HECM program. We believe there are opportunities to expand the accessibility of this program, enhance loss mitigation options and broaden HECM’s reach to assist underserved communities. We look forward to continuing our dialogue with HUD on these enhancements.”

Other highlights:

- FHA insured 64,437 HECMs in FY 2022, representing a Maximum Claim Amount of $32.10 billion, a record high for the HECM program;

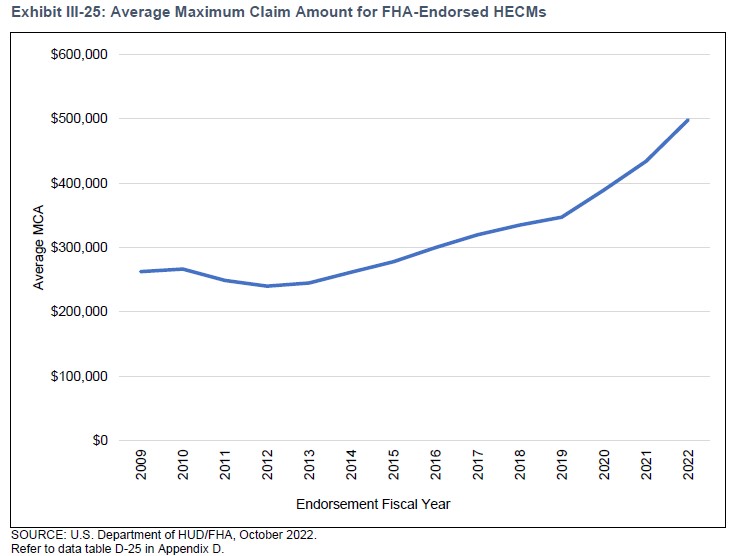

- Average MCA per HECM endorsement has continued to rise since FY 2013, increasing to a record $498,221 in FY 2022;

- The share of HECM refinances increased from 46.72 percent of endorsements in FY 2021 to 48.88 percent in FY 2022, as homeowners took advantage of favorable house prices to extract more equity.