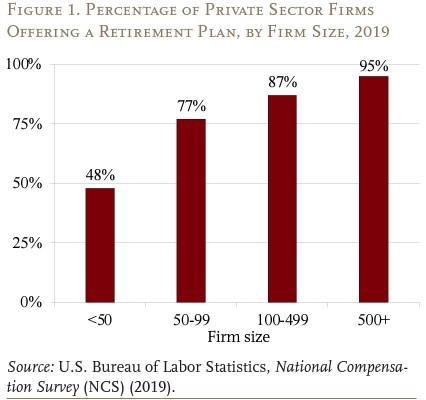

Roughly half of America’s small businesses (those with fewer than 100 employees) offer a retirement plan.

To better understand why the other half doesn’t, the Center for Retirement Research at Boston College examined the characteristics of small firms that do and do not offer retirement plans and published the results in a new Issue Brief.

“Some firms claim that they are simply not big enough and do not feel that they are firmly enough established to offer a plan,” says the Issue Brief. “Indeed, many small firms are new, and it may take a few years before setting up a workplace retirement plan is a real option.

The second factor cited by small employers for not offering a plan is that their employees would prefer to get their compensation in cash wages, or, if they have to choose among benefits, they would much prefer health insurance to retirement benefits.

”A less compelling reason for not offering a plan is the concern that establishing and maintaining one would be too costly; however, surveys indicate a substantial lack of knowledge about the options, the costs, and even the need to provide a match in a 401(k) plan. This area seems like fertile ground to make inroads into expanding coverage – especially with the advent of PEPs (Pooled Employer Plans),” says the Issue Brief. Read the full report.