HMBS payoffs fell again in December, as the refinancing retreat continued. December payoffs totaled about $815 million, the lowest payoff amount in 23 months and the lowest payoff rate in nearly 7 years. Outstanding HMBS rose to a record $59.8 billion due to faster roll-up from rising interest rates and the drop in payoffs.

Higher interest rates finally caught up with the HMBS market in 2022, driving down Principal Limit Factors (initial loan-to-value ratios or “PLFs”) sharply, but big trouble came in the fourth quarter. In October, the trend of declining home prices became clearer and more widespread. In November, Reverse Mortgage Funding, holder of the largest HMBS servicing portfolio, declared bankruptcy. In December, AAG, the top HECM originator, agreed to sell its assets to Finance of America Reverse, taking another major HMBS issuer out of the picture.

Also in December, Ginnie Mae took over RMF’s HMBS portfolio. In Ginnie Mae’s recent data release, “Ginnie Mae – Reverse Mortgage Funding 42” is now shown as the issuer of record for the 4,053 former RMF pools. This new “Issuer 42” accounts for over $21 billion, about 35% of all outstanding HMBS.

The 10-year treasury fell sharply in recent weeks and the lending limit/MCA was raised to $1,089,300 in 2023; it remains to be seen if this will slow the steady decline in industry volume.

When a HECM loan balance reaches 98% of its MCA, the HMBS issuer is required to buy the loans out of the HMBS pool, and then may assign the loan to HUD if the loan is not in default. This is effectively a prepayment event for the HMBS investor, even though the underlying HECM loan remains outstanding. According to our friends at Recursion, over 53% of HMBS payoffs last month were due to Mandatory Purchase. Last month’s 98% MCA Mandatory Purchases totaled nearly $414 million, the highest total in 3 years.

Including the Mandatory Purchases, HMBS paid off at a 15.2% annual rate in December, the slowest one-month rate since February 2016. Exclusive of Mandatory Purchases, the rate of HMBS payoffs is falling rapidly. HMBS payoffs resulting from underlying HECM loan payoffs, including payoffs due to mortality and refinancing, fell to about 7% for the first time in 3 years, barely one-third the rate of a year ago.

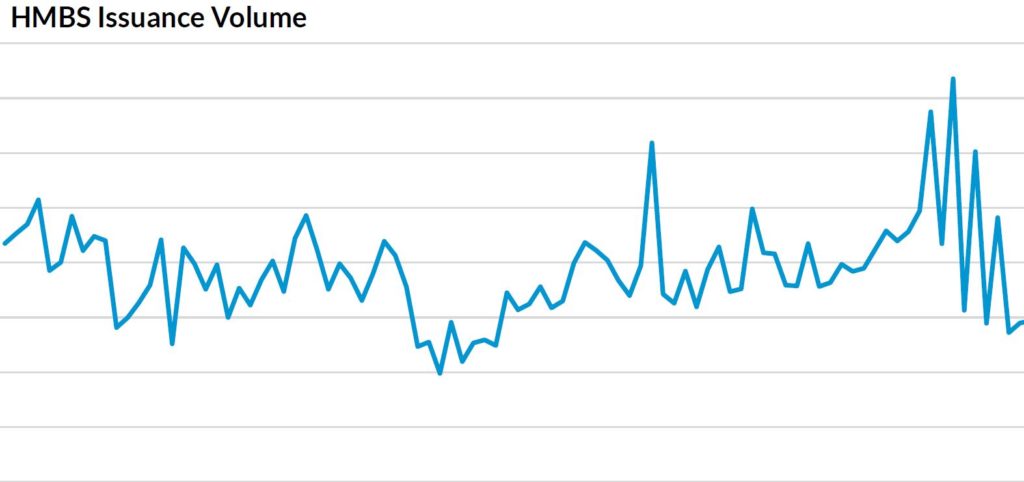

Despite the recent industry volume slowdown, 2022 set a new record: just under $14 billion in HMBS issued, topping last year’s record of $13.2 billion. With the strong headwinds faced by the reverse mortgage industry, the remaining HMBS issuers will struggle to reach half that total in 2023.

(Note: The following was republished with permission from New View Advisors, which compiled this data from publicly available Ginnie Mae data as well as private sources.)