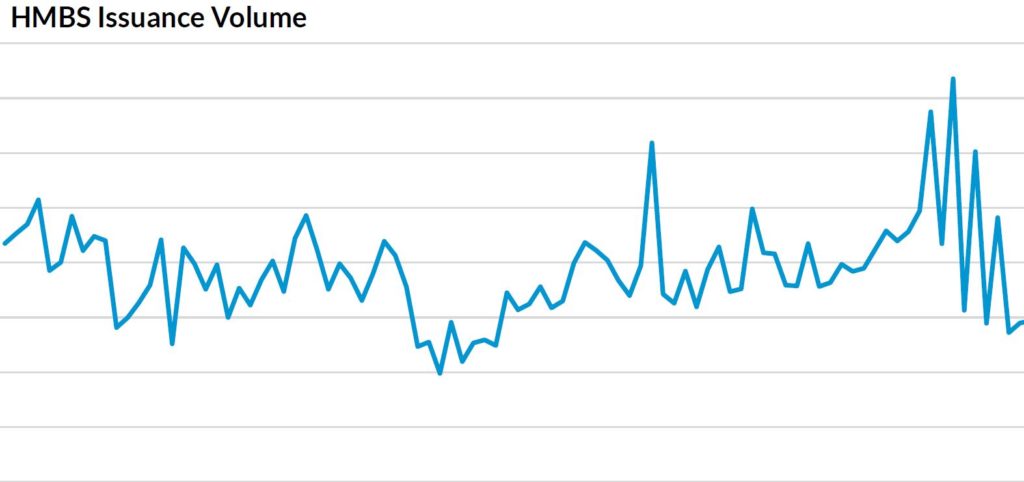

HECM Mortgage-Backed Securities (“HMBS”) issuance collapsed in January to $523 million, falling for the ninth straight month. This monthly total is the lowest in nearly 3 years and the third lowest since 2014. Only 62 pools were issued, the lowest monthly issuance count in ten years.

On November 30 of last year, Reverse Mortgage Funding (“RMF”), the largest HMBS issuer of record, filed for bankruptcy. As a result, Ginnie Mae acquired RMF’s HMBS portfolio. Ginnie Mae/RMF issued no HMBS pools in January. The fate of this large HMBS portfolio is still unclear at this time.

HMBS issuance set a new record in 2022, with nearly $14 billion issued. In the current market environment, HMBS issuers will be hard-pressed to come anywhere near those numbers.

January’s original (first participation) production fell sharply to $347 million, down from $448 million in December, $516 million in November and less than one-fourth of April 2022’s record $1.4 billion in new issuance. January’s original new loan pool production was also much less than that of January 2022, when approximately $1.18 billion in original new HMBS pools were issued.

The 62 pools issued in January consisted of 23 first-participation or original pools and 39 tail pools. Original pools are those HMBS pools backed by first participations in previously uncertificated HECM loans. Tail HMBS issuances are HMBS pools consisting of subsequent participations. Tails are not from new loans, but they do represent new amounts lent. With Ginnie Mae/RMF abstaining from issuance, last month’s tail pool issuances totaled $175 million, well below the typical range.

(Note: The following was republished with permission from New View Advisors, which compiled this data from publicly available Ginnie Mae data as well as private sources.)