The percentage of workers who contributed to workplace 401(k) plans increased between 2006 and 2021 as did the percentage of funds they deferred to their retirement plans, according to new research published by Vanguard.

The report notes, “Baby boomers were the first generation with access to defined contribution (DC) retirement plans throughout a meaningful part of their careers. Millennials were the first generation to have access to automatic enrollment and automatic investment solutions in DC plans during their early working years. This paper highlights some of the generational differences we have observed in our recordkeeping data over a 15-year period as a result of automatic solutions.”

Highlights include:

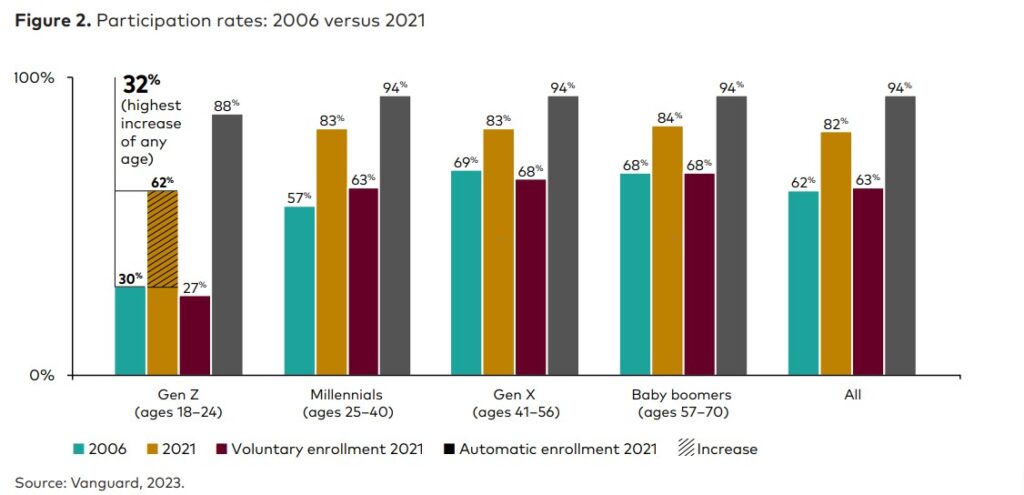

- The overall participation rate of employees increased from 62 percent in 2006 to 82 percent in 2021, largely because more plans adopted automatic enrollment. Generation Z’s participation rate was more than twice as high as similarly aged employees in 2006;

- The average deferral rate among plan participants—the amount withheld from participant paychecks—increased slightly from 7.2 percent in 2006 to 7.6 percent in 2021;

- The aggregate contribution rate, which combines the employee deferral amount and the employer contribution, rose from 11.8 percent in 2006 to 12.3 percent in 2021; and

- Across all working age groups, the median participant account balance increased from $44,524 in 2006 to $48,365 in 2021. Account balances for Baby Boomers (ages 57-70) rose from $96,000 in 2006 to $139,000 in 2021.