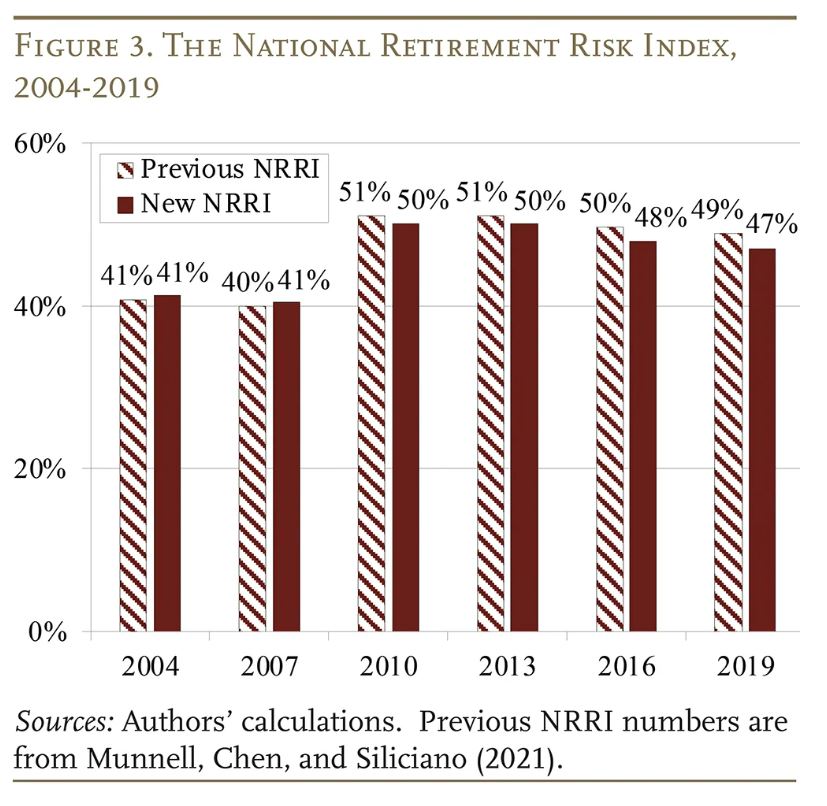

The Center for Retirement Research at Boston College announced that it has modernized its National Retirement Risk Index which measures and analyzes the share of working-age households that could fall short in retirement more accurately.

The CRR publishes the NRRI every three years, the last time in 2019, to gauge retirement preparedness in America.

“After recalculating the NRRI using the most updated methodology, the bottom line from our previous studies still holds—that about half of today’s households will not have enough retirement income to maintain their pre-retirement standard of living, even if they work to age 65 and annuitize all their financial assets, including the receipts from a reverse mortgage on their homes,” says the CRR. “The robustness of the results confirms the retirement saving issue faced by today’s working-age households, and that we need to fix our retirement system so that employer plan coverage is universal. Only with continuous coverage will workers be able to accumulate adequate resources to maintain their standard of living in retirement.”

Among the changes made by the CRR, reverse mortgage calculations now use updated interest rate assumptions and principal limit factor tables. Read more about the NRRI and recent changes.