The Federal Reserve Board issued its Economic Well-Being of U.S. Households in 2022 report, which examines the financial lives of U.S. adults and their families.

The report draws from the 10th annual Survey of Household Economics and Decisionmaking, or SHED, which was conducted in October 2022.

Highlights, as they relate to retirement issues, include:

- Progress toward retirement savings goals declined in 2022. Thirty-one percent of non-retirees thought their retirement savings plan was on track, down from 40 percent in 2021.

- 79 percent of all retirees said they were doing at least okay financially. Among retirees whose family income included wages or other sources of labor income, a slightly higher share (83 percent) reported they were doing at least okay financially.

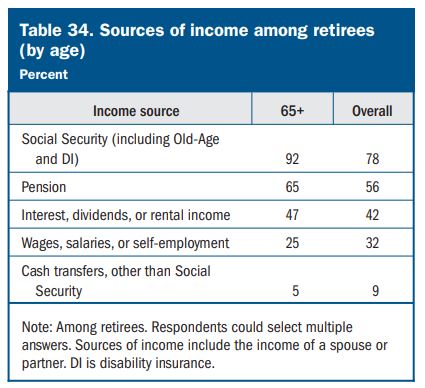

- Social Security remained the most common source of retirement income, but 79 percent of retirees had one or more sources of private income. This included 56 percent of retirees with income from a pension; 42 percent with interest, dividends, or rental income; and 32 percent with labor income.

- Seventy-eight percent of retirees received income from Social Security in the prior 12 months, including 92 percent of retirees aged 65 or older.