T. Rowe Price published a white paper focused on how the primary sources of financial stress—specifically, the lack of emergency savings and the burden of student loan debt—can negatively affect an individual’s retirement savings.

The paper provides insights into how provisions in the recently passed SECURE 2.0 Act retirement legislation can help with these challenges. The findings are based on multiple studies conducted by T. Rowe Price, with a focus on the firm’s annual Retirement Savings and Spending study, which surveys a nationally representative group of 401(k) participants.

According to the white paper, 55 percent of those surveyed said that they are not saving enough for retirement or are not sure if they are. Of that group, 62 percent said that they were saving all that they could afford.

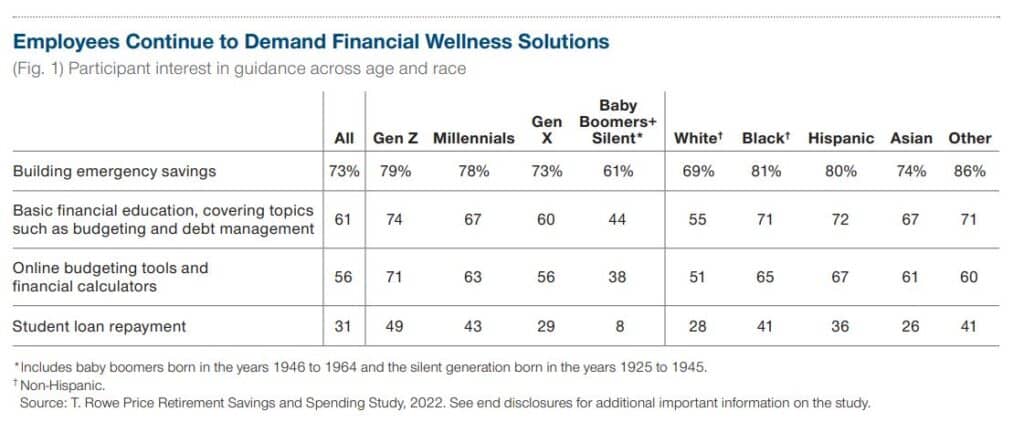

Nearly all workers – 91 percent – said having enough savings for an emergency was a major or minor financial goal. Nearly one-quarter of respondents said they were making little or practically no progress toward saving for emergencies. In addition, 14 percent of those surveyed said they were likely to tap into their workplace retirement accounts to cover unexpected expenses. Read the full white paper.