Vanguard recently examined the records of five million clients and released its annual report on the state of the nation’s habits around saving for retirement, which found that participation rates among workers with access to 401(k) plans jumped over the past five years from 72 percent to 83 percent in 2022.

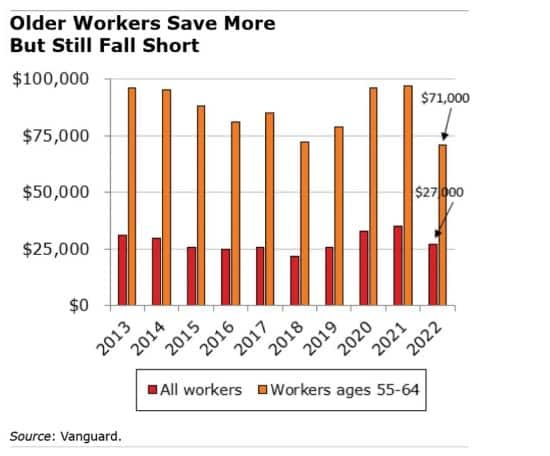

However, the typical worker in Vanguard’s client base with a decade or less to retirement has saved only $71,000 in a 401(k), the lowest level in that age group in more than 10 years of Vanguard data. Other highlights:

- Only about half of the people earning less than $30,000 were saving last year, compared with more than 90 percent of people earning over $100,000, although research shows that state-sponsored IRA programs are reaching more low-wage workers.

- The average deferral rate was 7.4 percent in 2022, up modestly from seven percent in 2013. Including both employee and employer contributions, the average total participant contribution rate was 11.3 percent, and the median was 10.6 percent.

- Throughout 2022, 2.8 percent of participants initiated a hardship withdrawal from their retirement account, up from 2.1 percent in 2021.