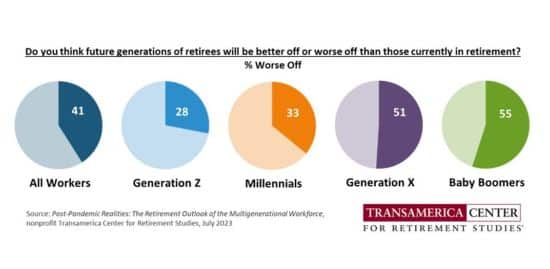

A recent survey published by the Transamerica Center for Retirement Studies® that examines the retirement outlook for Generation Z, Millennials, Generation X, and Baby Boomers finds that 41 percent of workers think that future generations of retirees will be worse off than those currently in retirement.

“Among those still in the workforce, Baby Boomers are especially vulnerable to employment setbacks, volatility in the financial markets, and increasing inflation – all of which could disrupt their retirement plans and with little or no ability to recover. It’s critically important they have contingency plans for the unexpected,” said TCRS CEO and President Catherine Collinson.

As it pertains to Baby Boomers, the survey highlights include:

- Almost half of Baby Boomer workers (49 percent) expect to or already are working past age 70 or do not plan to retire.

- Their greatest retirement fears are outliving their savings and investments (49 percent), declining health that requires long-term care (43 percent), and that Social Security will be reduced or cease to exist in the future (40 percent).

- Forty-one percent of Baby Boomer workers expect Social Security to be their primary source of retirement income, while almost four in 10 (39 percent) expect to rely on income from 401(k)s, 403(b)s, and IRAs (28 percent) or other savings and investments (11 percent).

- Baby Boomer workers have saved $289,000 (estimated median) in total household retirement accounts and only $25,000 (median) in emergency savings.