New research from the Transamerica Center for Retirement Research, titled Life in Retirement: Pre-Retiree Expectations and Retiree Realities, describes the retirement aspirations and insecurities of retirees and age 50+ workers.

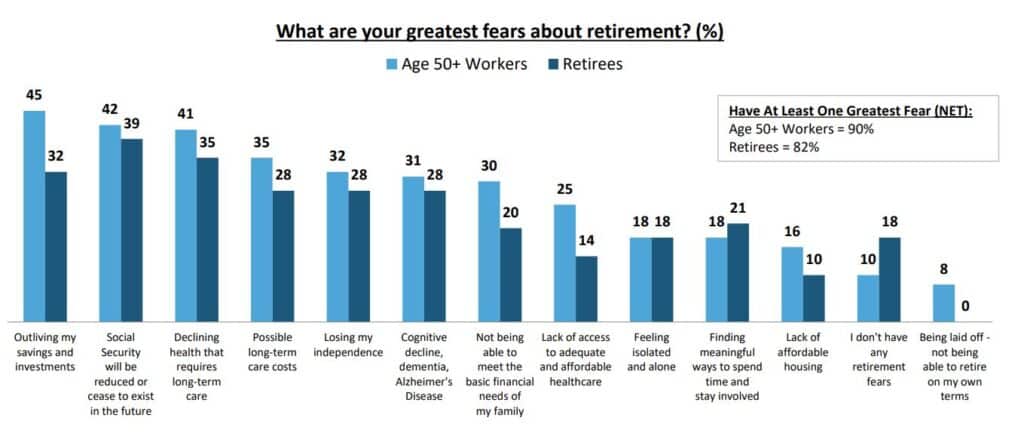

The findings suggest that pre-retirees and retirees share a positive view of retirement as a time of freedom and enjoyment to travel, spend time with family and friends, and enjoy personal pursuits. “Simultaneously, many are fearful of potential changes to their Social Security benefits, their financial situation, and the possible need for long-term care,” says the report.

Other highlights:

- More than eight in 10 retirees and age 50+ workers share an upbeat outlook on life including having close relationships with family and/or friends (88%, 87%, respectively), being generally happy (89%, 87%), and enjoying life (86%, 82%).

- Age 50+ workers are more likely than retirees to share fears of outliving their savings and investments (45%, 32%, respectively), declining health that requires long-term care (41%, 35%), possible long-term care costs (35%, 28%), losing their independence (32%, 28%), not being able to meet the basic financial needs of their family (30%, 20%).

- Age 50+ workers and retirees are planning to live long lives (age 89, age 90, respectively) (medians). Eleven percent of age 50+ workers and retirees are planning to live to age 100 or older. Many age 50+ workers and retirees are “not sure” (39%, 47%), which is a reasonable answer but not useful for financial planning.