While retirement savings behaviors remain strong, Fidelity Investments® reported an uptick in hardship withdrawals and 401(k) loans in its Q3 2023 retirement analysis as workers struggle with short-term financial challenges.

By the numbers:

- In Q3, 2.3 percent of workers took hardship withdrawals, up from 1.8 percent in Q3 2022. The top two reasons behind this uptick were avoiding foreclosure/eviction and medical expenses.

- 2.8 percent of 401(k) participants took a loan, compared to 2.4 percent in Q3 2022. The percentage of workers with a loan outstanding has increased slightly to 17.6 percent, up from 17.2 percent last quarter and 16.8 percent in Q3 2022.

- Hardship withdrawals are allowed for large, unexpected expenses. Unlike a 401(k) loan, the funds need not be repaid, but you must pay taxes on the amount of the withdrawal.

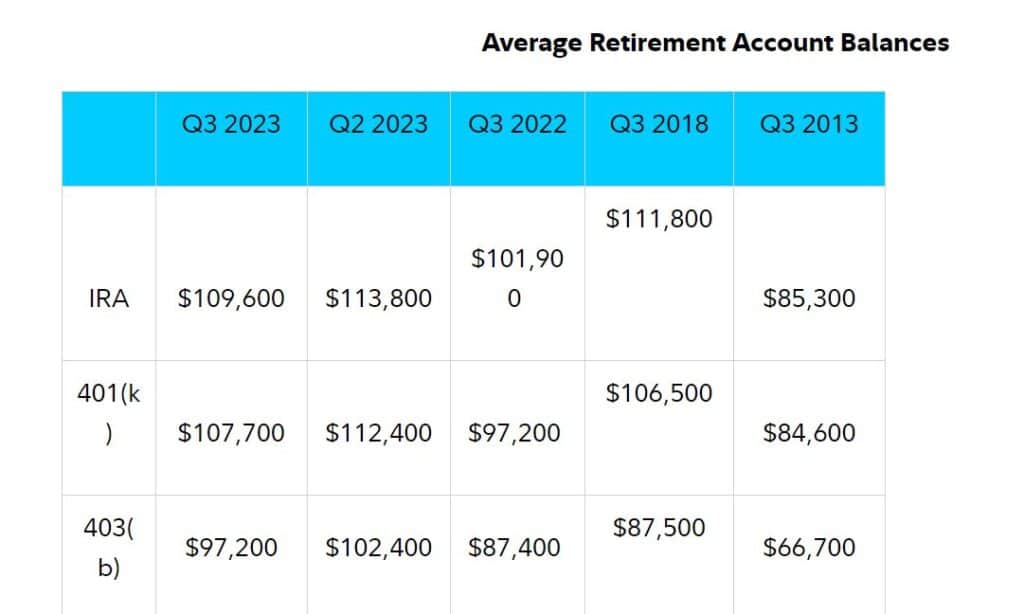

Bottom line: Fidelity says retirement balances are up over a year ago and savings rates remain steady and strong.

- Companies are also finding ways to help employees deal with unexpected expenses that can derail saving for retirement.