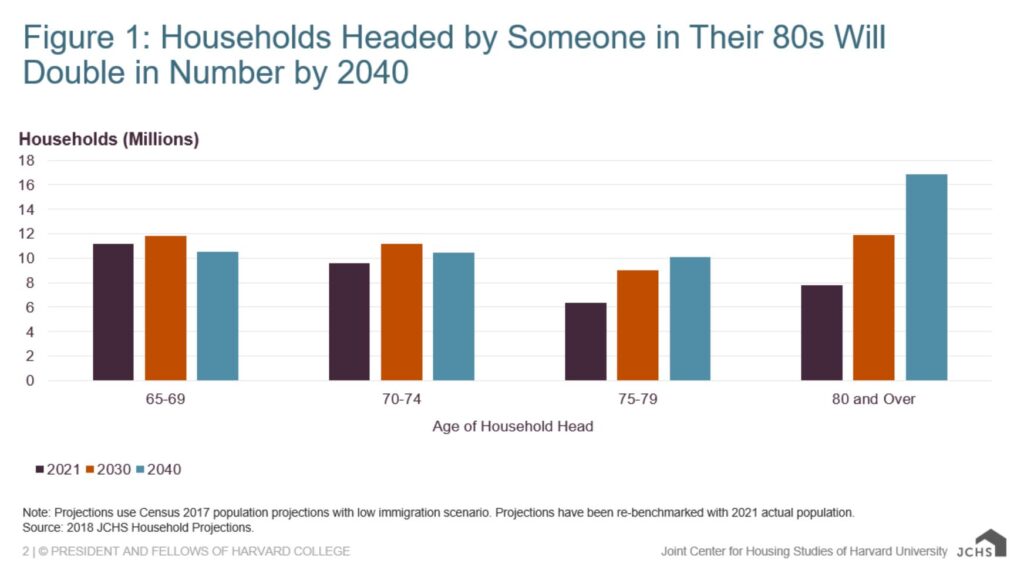

The number of households headed by a person aged 80 and over will more than double to nearly 17 million between 2021 and 2040. However, the United States is ill-equipped to provide adequate housing and supportive services to meet this demand, according to a new report from the Harvard Joint Center for Housing Studies.

Why it matters: Older adults, whose incomes are often fixed or declining, increasingly face the twin challenges of securing affordable housing and the services they need to remain in the home of their choice.

- By the numbers: In 2021, an all-time high of nearly 11.2 million older adults were cost-burdened, meaning they spent more than 30 percent of their income on housing.

- Costs of LTC: The costs of long-term care average over $100 per day nationwide. When LTC services are added to housing costs, only 14 percent of single people 75 and over can afford a daily visit from a paid caregiver, and just 13 percent can afford to move to assisted living.

- Between 1989 and 2022, the share of homeowners 65 to 79 with a mortgage increased from 24 to 41 percent. Over 30 percent of homeowners aged 80 and over are also carrying mortgages, up from just three percent three decades ago.

Bottom Line: The report notes that older homeowners with slightly higher incomes unable to afford both housing and services could benefit from help leveraging their housing equity, where it is sufficient to cover the costs of care.

Other policy recommendations: Increased government support in the form of additional assistance for rent, accessibility modifications, and services and supports for older households with lower incomes could help alleviate the dual burden of housing and care costs.