Large majorities of Americans of all races and ethnicities think about retirement in similar ways, calculating how much money they’ll need and how long they have to save it. But the similarities end there, as gaps emerge in savings rates, confidence in their retirement plans, and other key measurements of retirement readiness.

Those are among the findings of the TIAA Institute’s new State of Financial Preparedness report.

Why it matters: 40% of U.S. households risk running short of money in retirement, says the TIAA Institute.

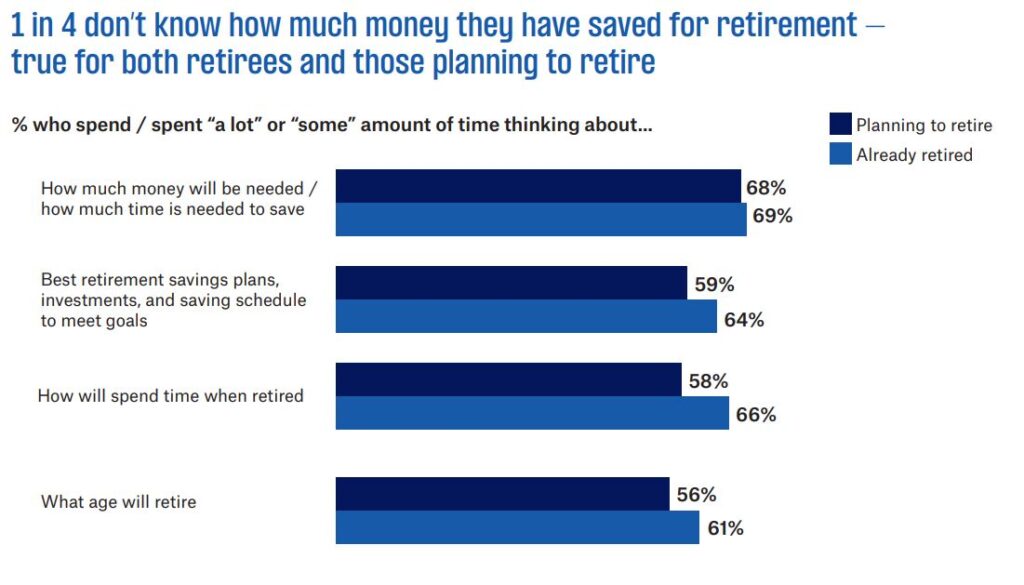

By the numbers: Overall, two-thirds of Americans (67%) have at least some money invested in retirement accounts, but close to one in four don’t know how much they’ve saved.

- More than seven in 10 whites (76%) and Asian Americans/Pacific Islanders (71%) have retirement accounts, but that’s true for only about half of Black (49%) and Hispanic (52%) Americans.

- One in eight Americans could not come up with $2,000 to pay for an unexpected need.