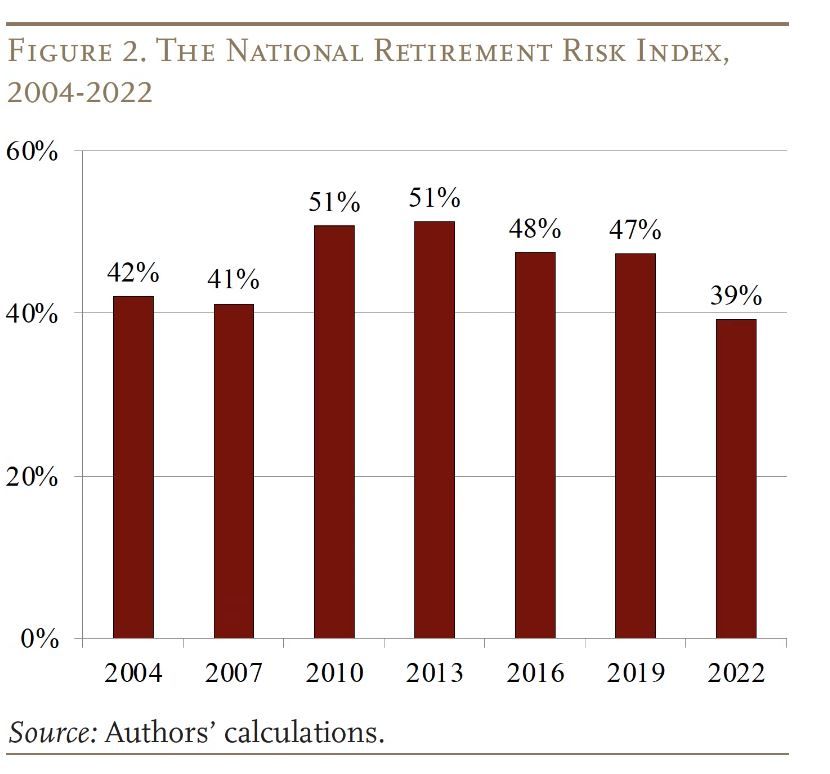

From 2019 to 2022, the National Retirement Risk Index dropped from 47 percent to 39 percent — the lowest level since the NRRI was created in 2004.

Why it matters: The NRRI, administered through Boston College’s Center for Retirement Research, measures the percentage of U.S. households who are at risk of being unable to maintain their pre-retirement standard of living in retirement.

The single biggest factor driving the improvement was soaring home values.

- In the NRRI, home prices have a significant impact because households are assumed to access their home equity at retirement by taking out a reverse mortgage. The higher the home value, the more equity households can extract through a reverse mortgage.

- Though these results are encouraging, the Center for Retirement Research says most people do not tap their home equity in retirement and prices may not stay at such high levels.

The bottom line: Even a conservative estimate shows a substantial portion – about two-fifths – of today’s households will not have enough retirement income to maintain their pre-retirement standard of living.