J.P. Morgan Asset Management released the 13th edition of its annual Guide to Retirement. This year’s Guide offers insights on the evolving landscape of retirement planning, focusing on key themes such as Social Security, guaranteed income, and the importance of long-term investment strategies.

Go deeper: Michael Conrath, chief retirement strategist at JPMorgan Asset Management, highlighted some of the key takeaways from the report while being interviewed for the Decoding Retirement podcast with Robert Powell.

By the numbers: Some of the noteworthy research compiled by JP Morgan includes:

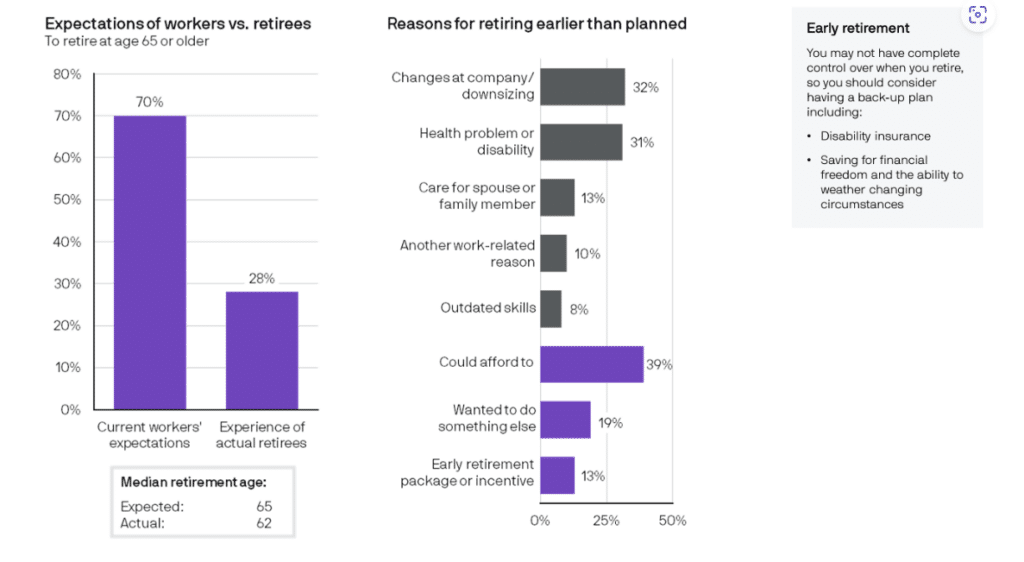

- Seventy percent of people say they want to work to age 65, but less than 30 percent make it to that age often due to circumstances out of their control. The vast majority retire by 62. “You may have to accelerate your savings and say, ‘I’m going to play it for 65, but I’m gonna actually save as if I’m going to retire at 62,’” says Powell.

- Based on family genetics, personal lifestyle and unexpected occurrences, people should plan for a 35-year retirement. “Investing a portion of your portfolio for growth is important to maintain your purchasing power over time,” advises the Guide to Retirement.

- Personal banking data examined by JP Morgan researchers found that 53 percent of households are partially retired. Some households enjoy working, said Conrath, but 54 percent of households are carrying credit card debt and want to work longer to pay off their debts before they transition to full retirement.

- Historically, households have been advised to spend four percent of their retirement assets annually, so that they have enough money to last 30 years. Monte Carlo simulations conducted by JP Morgan suggest that two-thirds of households who follow this strategy will have the same amount of money in their portfolios after 30 years compared to when they initially retired.