Over 5.3 million households paid more than $4,000 a year for their property insurance in 2023 but costs varied across the country, according to the U.S. Census Bureau’s American Community Survey (ACS).

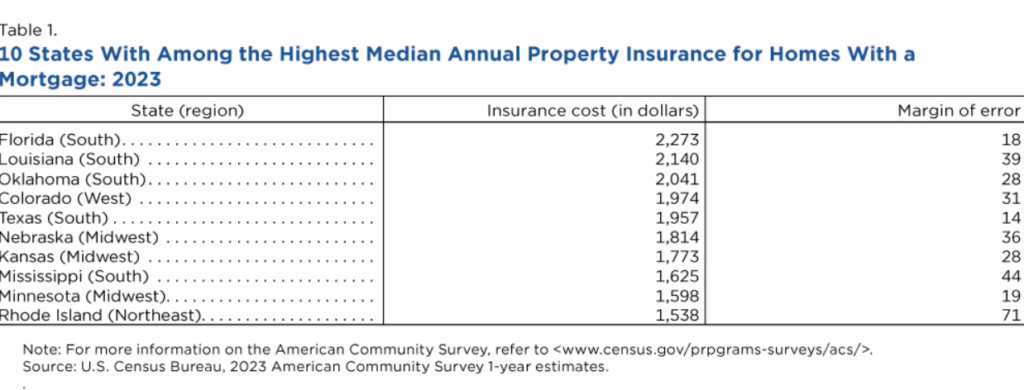

States with the highest annual insurance costs are not just located along the coasts but throughout the country (see image above). Of those ten states with the highest annual insurance costs for mortgaged homes in 2023:

- Five were in the South: Florida, Louisiana, Oklahoma, Texas, and Mississippi.

- Three were in the Midwest: Nebraska, Kansas, and Minnesota.

- One was in the West: Colorado.

- One was in the Northeast: Rhode Island.

States with the lowest property insurance costs included:

- Nevada ($929)

- Utah ($939)

- Maine ($944)

- West Virginia ($949)

- Delaware ($970)

- Vermont ($994)

- Wisconsin ($1,009)

- Oregon ($1,012)

- Idaho ($1,016)

- Pennsylvania ($1,026)