Morningstar, Inc., a leading provider of investment research and financial services, launched the Morningstar Center for Retirement and Policy Studies this week and published an inaugural report, titled “Retirement Plan Landscape Report,” that assesses the health of the U.S. retirement system.

The report explores trends across coverage, assets and numbers of defined-contribution plans, such as 401(k)s; costs to workers and retirees within these plans, as well as their investments; the kinds of investments held by these plans; and the continued role of defined-benefit plans (i.e., company pensions). Key takeaways:

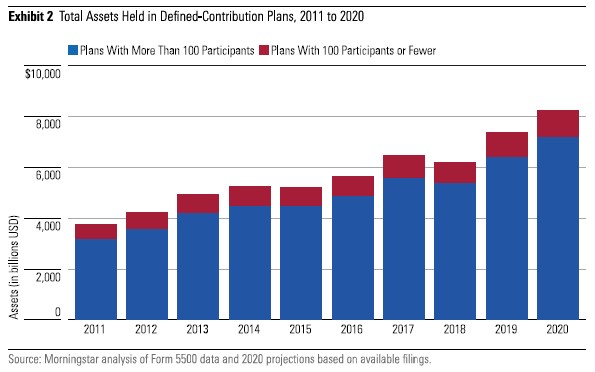

- The U.S. retirement system appears to be stable, but that obscures the fragility of a system that loses thousands of plans and billions of assets every year. Morningstar says 380,000 defined-contribution plans closed between 2011 and 2020 totaling $4.61 trillion in lost assets. The report adds, “The COVID-19 pandemic did not dramatically impact retirement security, but policymakers and plan sponsors must be on guard—future economic disruptions certainly could mean the system stops adding plans at a fast enough rate to replace the tens of thousands that close every year; and

- People who work for smaller employers and participate in small plans pay around double the cost to invest as participants at larger plans, around 88 basis points in total compared with 41 basis points, respectively. Small plans also feature a much wider range of fees between plans, with more than 30 percent of plans costing participants more than 100 basis points in total. In short, the U.S. system does not work nearly as well for people who are not fortunate enough to work for larger, established employers. Congress recently created pooled employer plans, which could help close this gap somewhat, but so far there has been little uptake. Read the full report.