The U.S. Department of Health and Human Services, through its Administration for Community Living (ACL), delivered to Congress a progress report on federal implementation of the 2022 National … more National Strategy to Support Family Caregivers

HUD Updates Counseling Delivery Options

The Department of Housing and Urban Development published a final rule to allow housing counseling agencies to use alternative communication methods, including virtual meeting tools, instead of providing … more HUD Updates Counseling Delivery Options

Big Changes Coming to Medicare Part D and Medicare Advantage

Medicareresources.org, an online resource for consumers, advises seniors to pay close attention to their mail leading up to the annual Medicare open enrollment period, which begins on October … more Big Changes Coming to Medicare Part D and Medicare Advantage

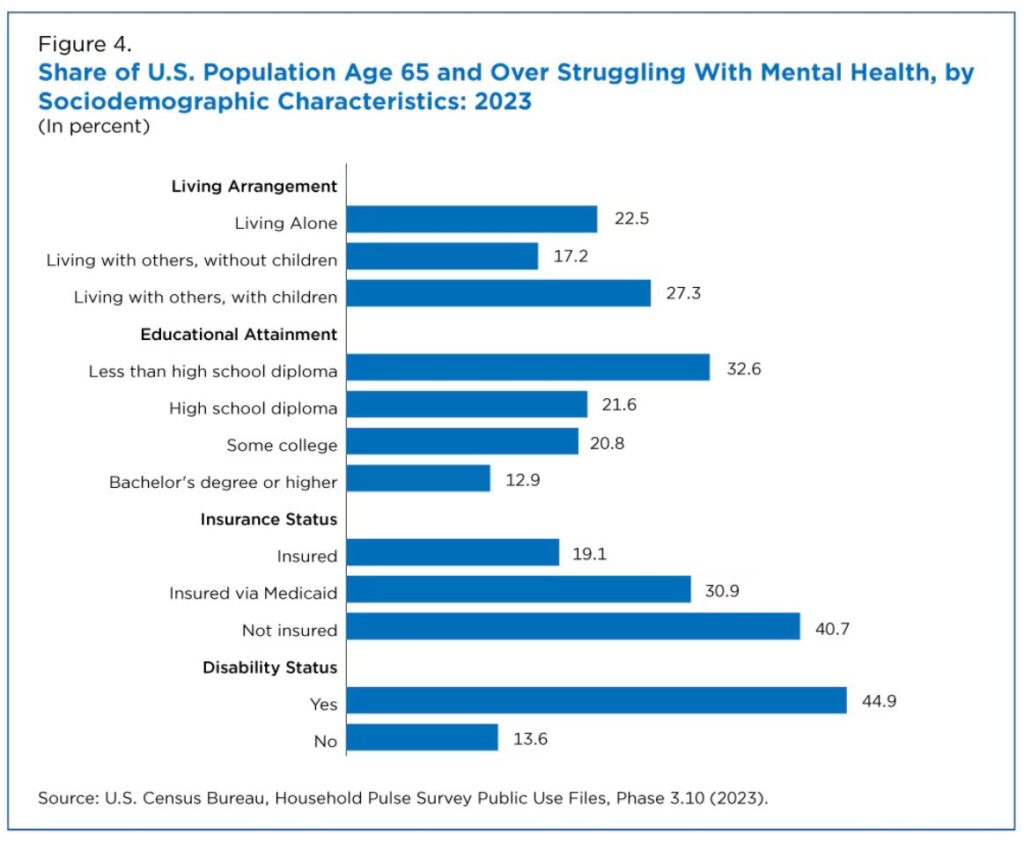

Mental Health Struggles Among Older Adults During the Pandemic

Older adults experienced fewer mental health challenges than younger adults during the COVID-19 pandemic but new research shows anxiety and depression levels among those 65 and older varied … more Mental Health Struggles Among Older Adults During the Pandemic

Survey Examines Middle-Class Finances, Retirement Preparations

According to a new survey published by the Transamerica Center for Retirement Studies, almost seven in 10 middle-class Americans are confident that they will be able to fully … more Survey Examines Middle-Class Finances, Retirement Preparations

HUD Finalizes Debenture Interest Updates

The Federal Housing Administration published updates for the payment of debenture interest on HECM claims and established a process for adjusting debenture interest for claims already filed for loans … more HUD Finalizes Debenture Interest Updates

DC Relaunches Reverse Mortgage T&I Program

The District of Columbia Housing Finance Agency will provide up to $40,000 under its Reverse Mortgage Insurance & Tax Payment Program (ReMIT) to help eligible homeowners pay delinquent … more DC Relaunches Reverse Mortgage T&I Program

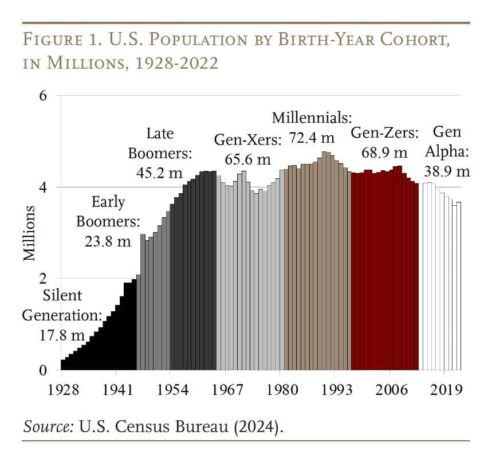

“Is the Retirement Picture for Millennials Looking Better?”

According to a new Issue Brief published by Boston College’s Center for Retirement Research, Millennials now have more net wealth relative to income in their 30s than Gen … more “Is the Retirement Picture for Millennials Looking Better?”

From the Top: Marion McDougall, CEO, Celink

For two decades, Celink has been the nation’s leading subservicer of reverse mortgages. Celink’s clients own the servicing rights to the loans they originate but contract with Celink … more From the Top: Marion McDougall, CEO, Celink

Servicing Corner: Preparing Borrowers and their Heirs for the Death of the Last Borrower

Being prepared in advance is key. The more the borrower and their heirs understand in advance, the smoother the resolution of the HECM loan and property will go … more Servicing Corner: Preparing Borrowers and their Heirs for the Death of the Last Borrower