You must be logged in to view this content.

Best and Worst States to Retire in 2024

Bankrate’s annual Best and Worst States to Retire Study found that Delaware is the best state for retirees in 2024, followed by West Virginia (2), Georgia (3), South … more Best and Worst States to Retire in 2024

What Do I Do When My Loan is Due?

The National Reverse Mortgage Lenders Association created, “What Do I Do When My Loan is Due?,” to walk reverse mortgage loan borrowers and their families through the end … more What Do I Do When My Loan is Due?

HUD Extends Foreclosure Relief to Maui Victims

The Federal Housing Administration extended its foreclosure moratorium for borrowers with FHA-insured mortgages in Maui County, HI, through January 1, 2025. Why it matters: This new extension — … more HUD Extends Foreclosure Relief to Maui Victims

Can MEPs Close the Retirement Savings Gap?

To encourage more small businesses to offer retirement savings options, policymakers approved changes in the SECURE Act of 2019 that made it easier for them to participate in … more Can MEPs Close the Retirement Savings Gap?

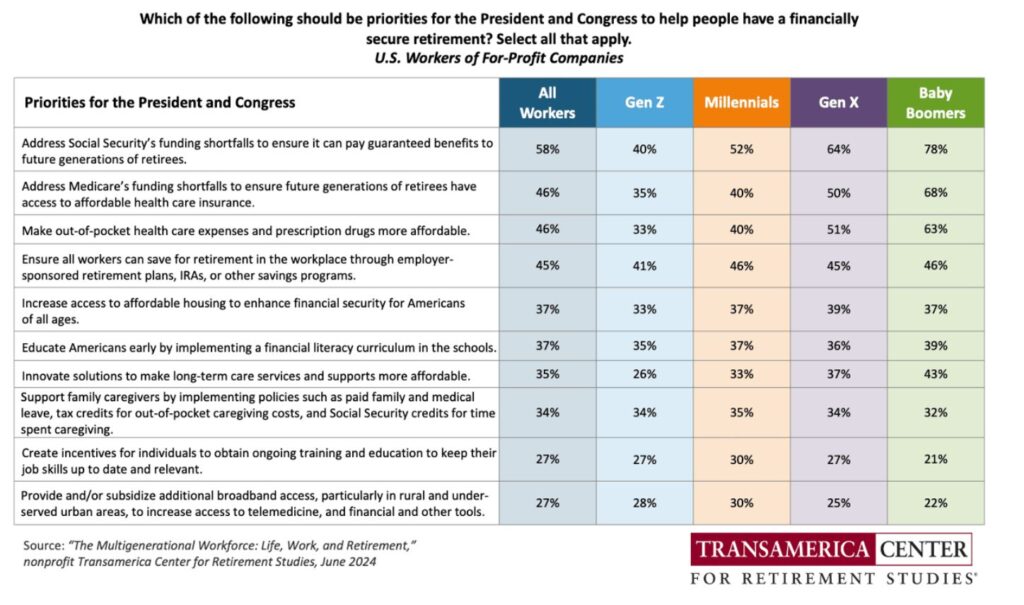

American Workers Cite Most Critical Retirement Policy Priorities

Fifty-eight percent of all workers — including 78 percent of Baby Boomers —believe the President and Congress should address Social Security’s funding shortfalls to ensure the program can … more American Workers Cite Most Critical Retirement Policy Priorities

HUD Proposes Updates to Debenture Interest Rates for HECM Claims

The Federal Housing Administration posted a draft Mortgagee Letter on its Drafting Table that proposes updates to HUD’s calculations for the payment of debenture interest on HECM claims. … more HUD Proposes Updates to Debenture Interest Rates for HECM Claims

HUD Proposes New Rules On Delinquent Note Sales

FHA published a proposed rule that seeks public feedback on its delinquent note sale program. What’s next: Public comments must be submitted by September 16, 2024. Why it … more HUD Proposes New Rules On Delinquent Note Sales

Recognize & Report Elder Financial Abuse

A new consumer brochure from the National Reverse Mortgage Lenders Association helps seniors and their loved ones recognize common scams and signs of financial exploitation. The free resource … more Recognize & Report Elder Financial Abuse

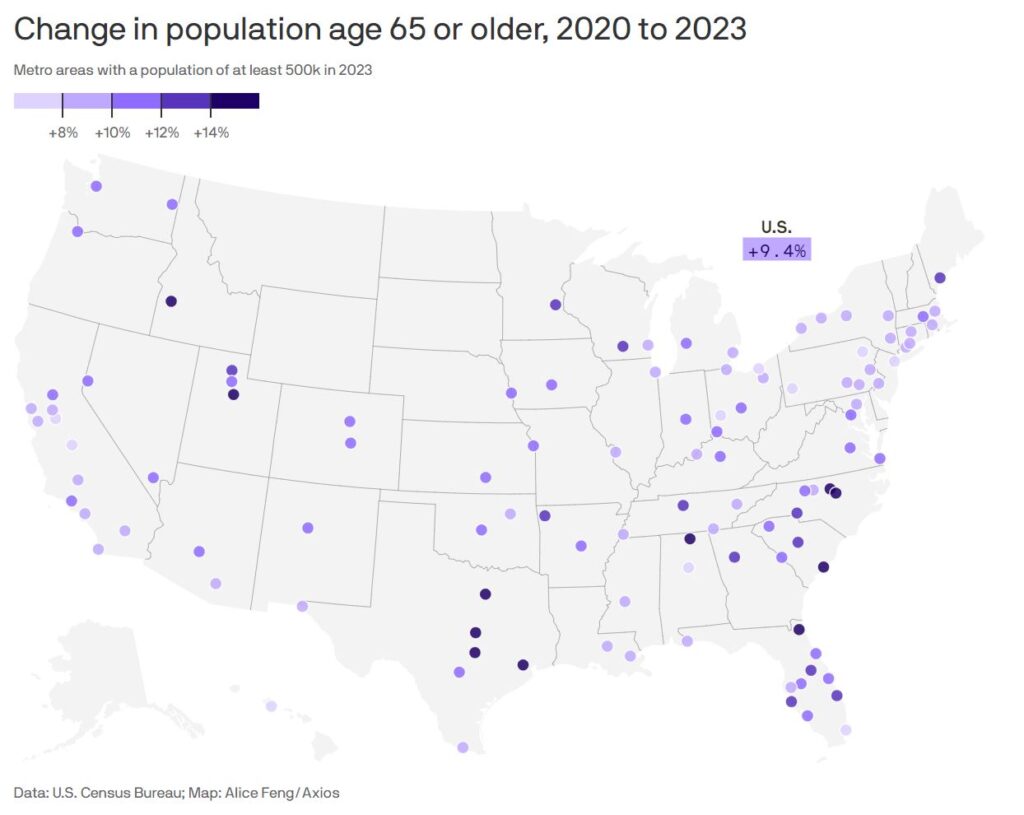

65+ Population Increases in Almost Every Metro Area

The 65-and-up population grew in all but one of America’s biggest cities from 2020 to 2023 — by close to 20 percent in some cases, according to the … more 65+ Population Increases in Almost Every Metro Area