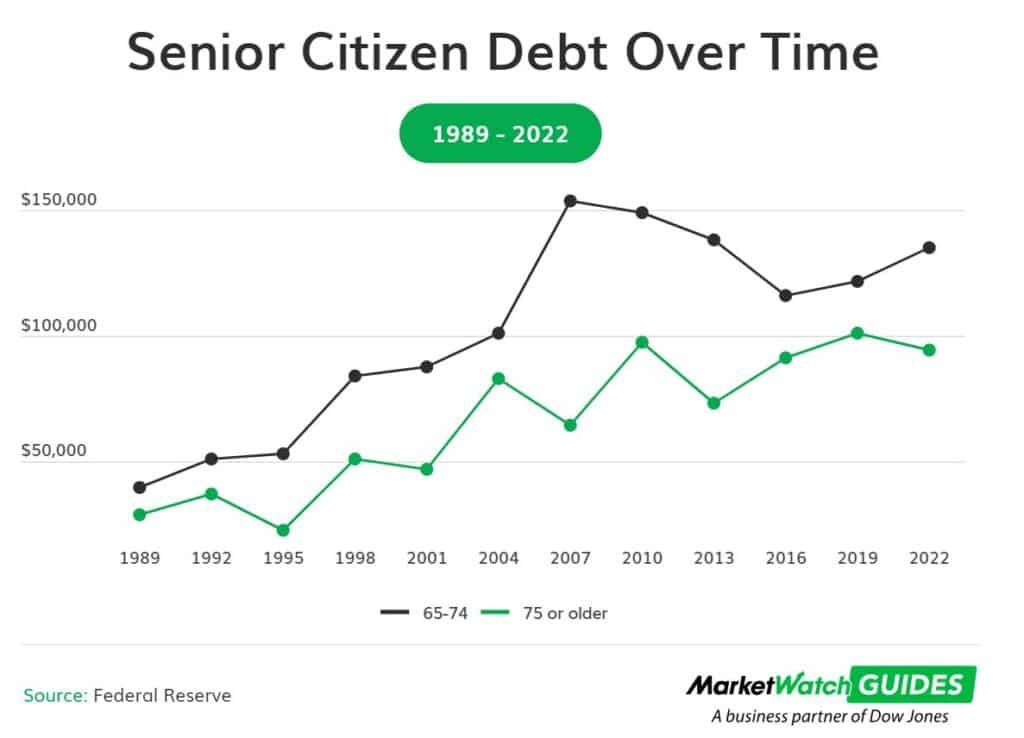

Adults aged 65 to 74 hold an average of $134,950 in debt, while individuals 75 and older hold an average of $94,620 in debt, according to Federal Reserve … more Senior Debt Levels Increase Threefold Over Past 35 Years

Member Spotlight: Michael Pankow, City First Mortgage Services, Inc.

To help our members get to know one another, NRMLA publishes periodic Member Spotlights featuring professionals from across the reverse mortgage ecosystem. Meet Michael Pankow, National Director of … more Member Spotlight: Michael Pankow, City First Mortgage Services, Inc.

Recent FDIC Focus on RESPA Sect. 8 Broker-Related Violations

NRMLA’s outside counsel, Weiner Brodsky Kider, PC, has published a memorandum for members that summarizes recent enforcement actions taken by the FDIC regarding violations of RESPA Section 8. … more Recent FDIC Focus on RESPA Sect. 8 Broker-Related Violations

FHA and GNMA Discuss Priorities and Achievements

The following article provides highlights from NRMLA’s Eastern Regional Meeting, May 29, in Washington, DC. During an interview with NRMLA Chairman Mike Kent, Deputy Assistant Secretary for Single-Family … more FHA and GNMA Discuss Priorities and Achievements

HHS Delivers Strategic Framework for National Plan on Aging

The U.S. Department of Health and Human Services, through its Administration for Community Living, released a report that lays the groundwork for a coordinated effort to create a … more HHS Delivers Strategic Framework for National Plan on Aging

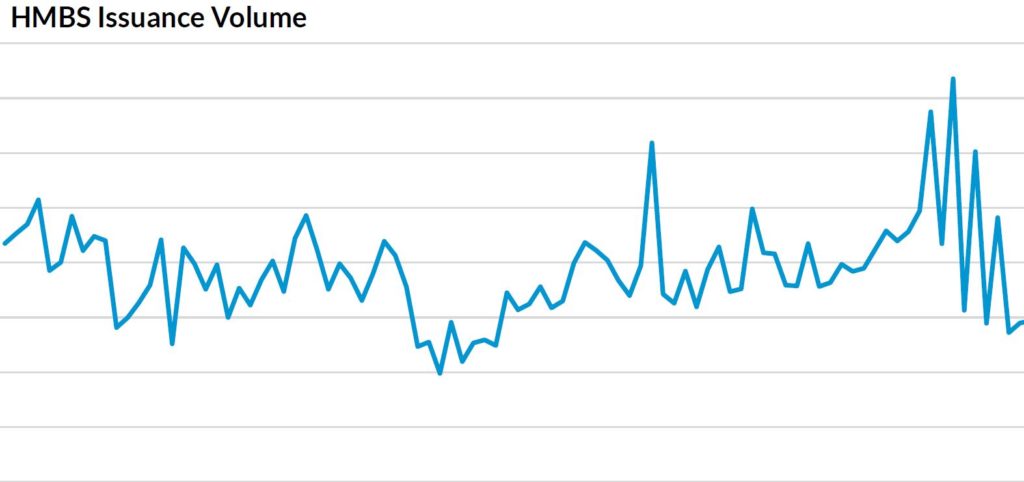

HMBS May 2024: May The Force Be With You

The HMBS new issue market continued to inch up in May. HECM Mortgage-Backed Securities (“HMBS”) issuance totaled $526 million in May, $23 million higher than April’s $503 million. … more HMBS May 2024: May The Force Be With You

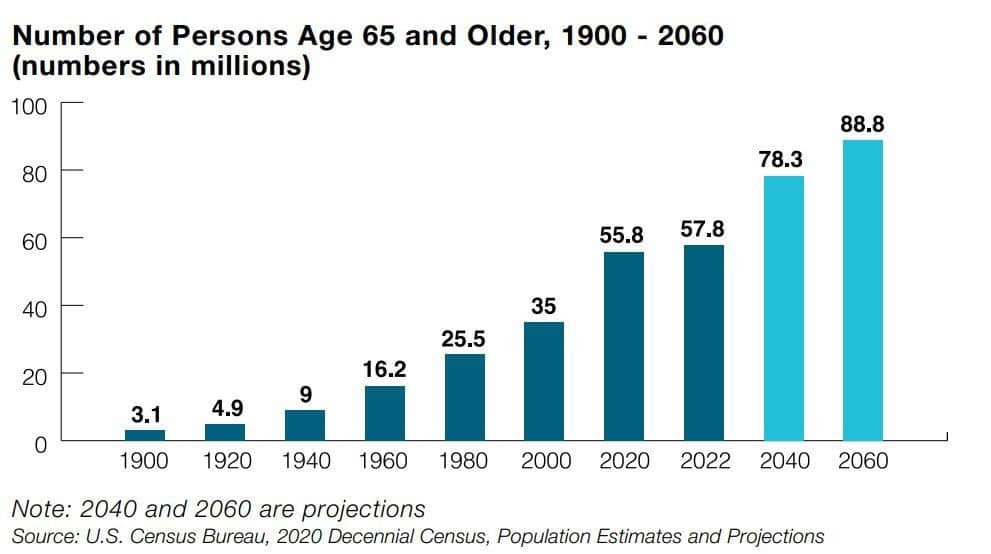

ACL Releases 2023 Profile of Older Americans

The Administration for Community Living released its 2023 Profile of Older Americans, illustrating the shifting demographics of Americans 65 and older. In 2022, 31.9 million women and 25.9 … more ACL Releases 2023 Profile of Older Americans

FHA Publishes Cybersecurity Reporting Requirements

As part of its ongoing efforts to protect the integrity of its systems and technology, the Federal Housing Administration published Mortgagee Letter 2024-10 to implement new procedures for … more FHA Publishes Cybersecurity Reporting Requirements

HUD Publishes Updates to HECM Handbook

The Department of Housing and Urban Development published a revised copy of the Single-Family Handbook 4000.1, which includes changes to the HECM section.Here is a link to the … more HUD Publishes Updates to HECM Handbook

Economic Uncertainty Has Changed Retirement Expectations

Sixty-one percent of investors say their expectations for retirement have changed significantly in the last five years, and nearly half say their dreams for retirement have been delayed, … more Economic Uncertainty Has Changed Retirement Expectations