NRMLA publishes the “Servicing Corner” so that we can better educate our readers on the most commonly asked questions that loan officers ask about HECM servicing guidelines. This … more Servicing Corner: Being Out of the Home For Extended Periods

Loan Servicing

HUD Publishes LIBOR Transition Final Rule

The Department of Housing and Urban Development published a final rule today that replaces the London Interbank Offered Rate (LIBOR) as an approved index for new and existing adjustable-rate forward … more HUD Publishes LIBOR Transition Final Rule

Urban Institute Offers Solutions For Improving HECM Program

The Urban Institute published an op-ed this week that proposes policy changes to the Home Equity Conversion Mortgage program to guarantee its long-term financial stability and to avoid … more Urban Institute Offers Solutions For Improving HECM Program

Protecting Your Clients From Wire Fraud

Email hacking and wire fraud, with the intent to misdirect wired funds, is a growing concern. With the help of our servicer and title company members, NRMLA has … more Protecting Your Clients From Wire Fraud

Compu-Link Officially Takes Over as HUD’s Contract Subservicer

NRMLA was notified this morning by HUD’s Tulsa Servicing Center that Compu-Link has officially taken over as the Department’s contract subservicer for assigned HECM reverse mortgages. Mail is … more Compu-Link Officially Takes Over as HUD’s Contract Subservicer

HUD Publishes Proposed Rule on LIBOR Transition

The U.S. Department of Housing and Urban Development published a proposed rule this week that would replace the London Interbank Offered Rate (LIBOR) with the Secured Overnight Financing Rate … more HUD Publishes Proposed Rule on LIBOR Transition

Helping Your Clients After a Natural Disaster

If you have clients in Puerto Rico or Florida, please consider sharing the Consumer Financial Protection Bureau’s consumer guide, Your Reverse Mortgage After a Natural Disaster. The resource guide … more Helping Your Clients After a Natural Disaster

FHA Updates HECM Due and Payable Requirements

The Federal Housing Administration changed its requirement for mortgagees to notify a borrower’s estate and heirs that a HECM has become due and payable from within 30 days … more FHA Updates HECM Due and Payable Requirements

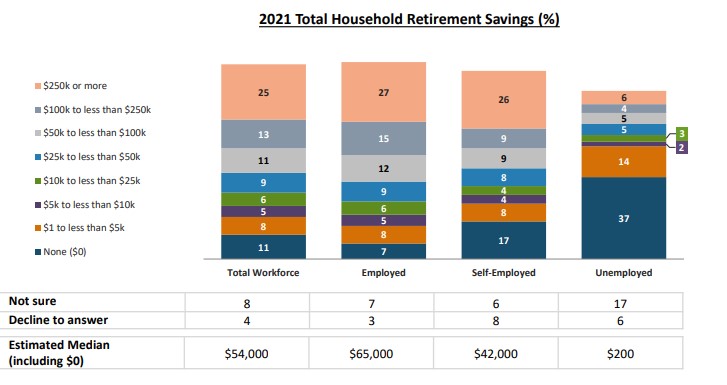

Transamerica: 39 Percent of Workers Tapped Retirement Accounts During COVID

While 79% of employed workers are saving for retirement, 39% of them said they tapped their retirement accounts during COVID, including 29% who took a loan and 27% … more Transamerica: 39 Percent of Workers Tapped Retirement Accounts During COVID